With UK inflation hitting double digits, essentially the most in over 40 years and the best within the G7 group of huge economies, the Financial institution of England is within the line of fireplace from politicians and economists.

The UK’s central financial institution was granted independence 25 years in the past with the transient of sustaining inflation at 2 per cent. However now there are questions round whether or not the officers in Threadneedle Road have misplaced management.

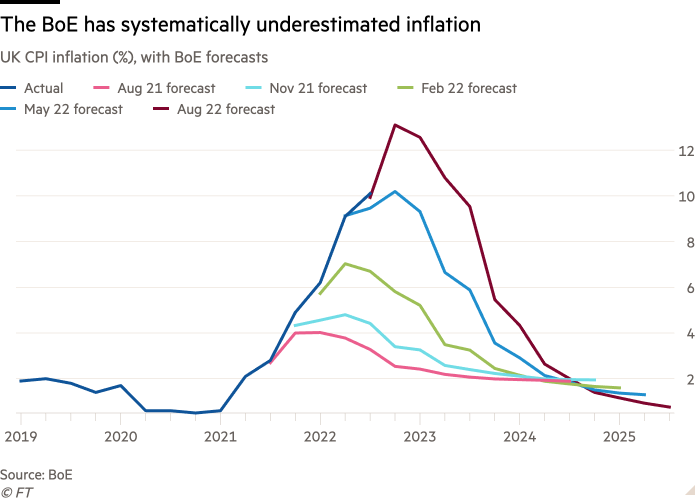

The workforce surrounding Conservative management hopeful Liz Truss is pointing the finger of blame at Andrew Bailey, the BoE governor, and his financial coverage colleagues. Within the phrases of Kwasi Kwarteng, favorite to be the following chancellor: “In case your goal for inflation is 2 per cent and also you’re predicting 13.3 per cent, one thing’s gone mistaken.”

Suella Braverman, attorney-general and a key Truss ally, went additional, telling Sky Information earlier this month that in a coming overview of the BoE, Truss would have a look at whether or not it was “match for objective when it comes to its complete exclusionary independence over rates of interest”.

The primary case in opposition to the BoE is that it was asleep on the wheel because the economic system emerged from the coronavirus disaster. This allowed spending to rise too shortly as officers failed to identify impediments to progress left by the pandemic. The consequence was extra demand and inflation.

Each quarter since Might 2021, the BoE has been stunned by the power and persistence of excessive inflation, this month elevating its estimate of peak inflation from 2.5 per cent to 13.3 per cent. Double-digit inflation is anticipated to final for a yr, properly in extra of inflation forecasts for different related economies.

Andrew Sentance, an outspoken former member of the BoE’s Financial Coverage Committee, mentioned the central financial institution had “acclimatised” folks to extraordinarily low rates of interest. This, he mentioned, was compounded after the pandemic by the BoE being “so gradual in noticing among the provide aspect and inflation issues that have been increase”.

Sentance is typically dismissed contained in the financial institution as a hawk who has at all times needed tighter financial coverage, however his views are shared by different former officers who don’t wish to publicly criticise the BoE.

One former senior official and MPC member was amazed that the committee had continued with its quantitative easing programme and had printed cash and acquired property all through 2021, regardless that the restoration was a lot stronger than it had anticipated.

Jagjit Chadha, director of the Nationwide Institute of Financial and Social Analysis, mentioned the BoE must have moved faster. “They appeared reluctant to say [interest rates] wanted to be normalised from such an awfully low degree,” he mentioned.

His level was echoed within the common conferences of a shadow MPC run by the rightwing think-tank the Institute of Financial Affairs. A majority of its members referred to as for QE to be stopped in April 2021 and for rates of interest to rise in July final yr, half a yr earlier than the BoE acted.

However Bailey dismisses these criticisms. There’s rising irritation contained in the BoE that it’s taking the blame for what it sees as largely a worldwide drawback past its management.

“I don’t know anyone who moderately can say they may have forecast a Ukrainian battle a yr in the past,” the governor complained within the press convention after the BoE told the public earlier this month {that a} recession was essential to carry down inflation.

The battle, together with impediments to international provide chains after Covid-19, have been all past the BoE’s management, he added, and blamed these components for each the UK’s excessive inflation and its tough financial outlook.

Bailey likes to notice that the BoE was among the many first of the main central banks to tighten financial coverage when it first raised rates of interest in December final yr.

MPC members are eager additionally to spotlight what they see as the advantages of an unbiased central financial institution controlling inflation.

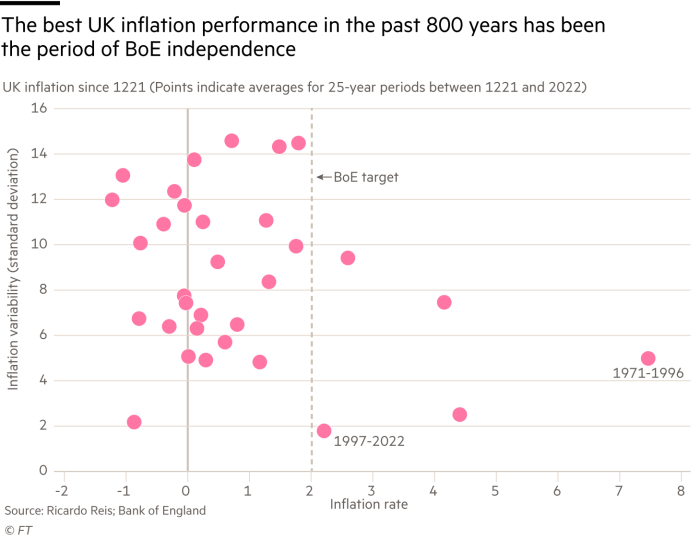

Jonathan Haskel, an exterior member of the rate of interest setting committee, took to Twitter with a chart exhibiting that regardless of the present issues, common UK inflation over the previous 25 years had nearly precisely hit the BoE’s 2 per cent goal on common — and this efficiency was higher than any earlier quarter century stretching again for 800 years.

There have been durations when inflation was decrease and likewise when it was near 2 per cent, however the difficulties of measurement, however there was no interval when it was as near the goal with as a lot stability because the interval since 1997, when the financial institution was granted independence.

Haskel’s chart was a modified model of 1 utilized by professor Ricardo Reis of the London Faculty of Economics to point out the advantages of central financial institution independence and inflation concentrating on.

However Haskel failed to say that it was reproduced from Reis’s newest academic paper, which units out errors he thinks all central banks have made because the begin of the pandemic, exacerbating inflation.

For now, in keeping with Reis, the problem is to carry down inflation. As it is extremely excessive, lowering it should contain nasty drugs. This consists of “accepting decrease ranges of actual exercise”, “performing vigorously and sharply within the close to future with elevating rates of interest” and “restating as loudly and convincingly as potential the primacy of worth stability because the aim that guides coverage”.

As soon as inflation is way too excessive, it’s expensive to carry down, no matter who was guilty.