The UK economic outlook for this year has improved, with analysts predicting a smaller contraction in output than previously because of falling energy prices and better than anticipated business and consumer sentiment.

In December and January, economists expected gross domestic product to drop by 1 per cent this year, according to data from Consensus Economics, which polls leading forecasters.

However, the data for the week of February 20 shows that economists are upgrading their forecasts. The average forecast involves a 0.6 per cent fall in GDP in 2023.

The UK recorded better economic news last week. The latest S&P Global/Cips flash composite purchasing managers’ index showed British business activity rebounded in February after six months of declining output.

Consumer confidence in February reached its highest level in almost a year, according to research group GfK. And official data about the public finances showed chancellor Jeremy Hunt was on course to net a windfall of £30bn after the UK recorded a surprise surplus in January.

While the cost of living crisis is far from over, and the Bank of England could raise interest rates further to curb inflation, there has been a sharp fall in wholesale energy prices, which soared after Russia’s invasion of Ukraine in February last year.

The UK wholesale gas price is now below £1.30 a therm, half the price of mid-December and down from a peak of £5.95 last August.

Liz Martins, economist at HSBC, said that given the better economic news and falling energy prices “it is now plausible that there is no recession at all”.

“That would be a remarkable result given the scale of the energy shock and monetary tightening that we have had,” she added.

Allan Monks, economist at JPMorgan, estimates the economy will expand by 0.4 per cent this year, partly owing to lower energy prices.

Ellie Henderson, economist at Investec, said “the fall in energy prices is the sunshine on a cloudy day” for the economy because it eased pressure on businesses and households.

Lower wholesale gas prices mean the government’s cap on household energy bills has become less expensive for ministers.

It has fuelled expectations that chancellor Jeremy Hunt may not proceed with plans to raise the cap from its current annual level of £2,500 to £3,000 in April.

Susannah Streeter, analyst at Hargreaves Lansdown, said the fall in gas prices should for business “mean an easing off of punishing input prices, which should enable them to limit hikes passed on to customers”.

More than three quarters of business leaders are confident about their companies’ prospects in 2023, according to a new survey published by the Boston Consulting Group.

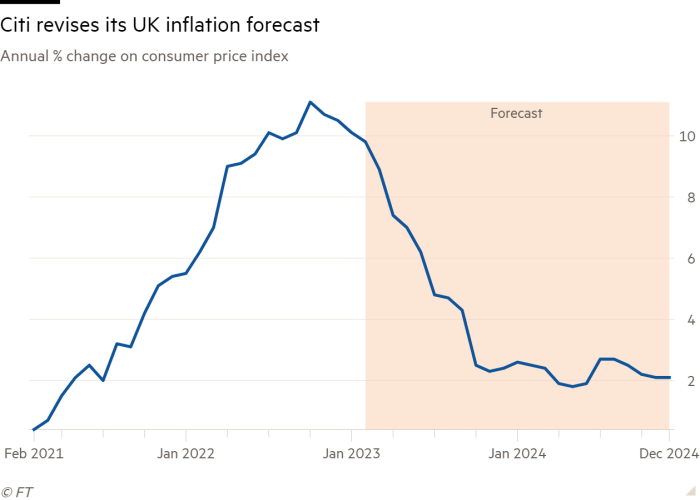

Some analysts, including Citigroup, expect inflation to return to the BoE target of 2 per cent in the second half of 2023. The central bank anticipates inflation of 4 per cent in the fourth quarter.

Monks predicts the unemployment rate to stabilise at about 3.7 per cent, instead of rising as previously expected. This “would mean there is scope for aggregate household real incomes to do better this year”, he said.

Victoria Clarke, economist at Santander CIB, expects “a return to positive real pay growth in the second half of the year, which should support household spending and economic momentum”.

However, the economy still has plenty of headwinds, not least because higher interest rates have yet to impact fully on consumers and businesses.

Streeter said demand in the economy could evaporate as more homeowners and businesses face up to sharply higher borrowing costs.

“So, a milder recession still can’t be ruled out and at the very least we’ll be heading for an early noughties period of stagnation,’’ she added.

Additional reporting by Daniel Thomas