Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning, and happy Friday.

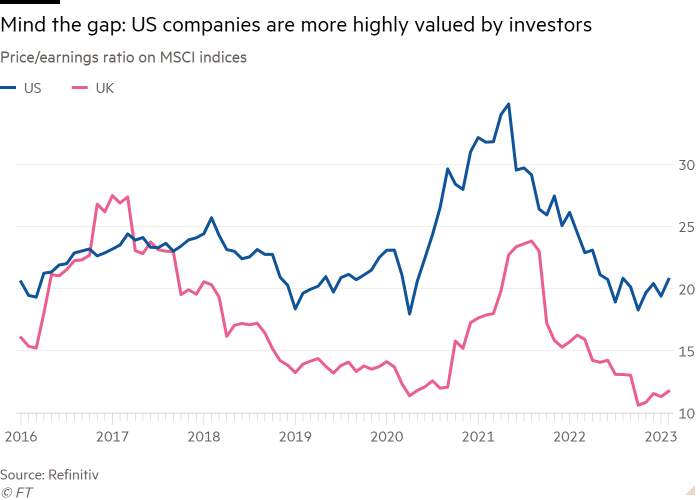

With Japan’s SoftBank and CRH, the world’s largest building materials group, both shunning the London stock market in favour of New York, we ask: is the City in trouble? Today’s chart of the day explains why investors might prefer the US.

Across the Atlantic, Washington has renewed its efforts to stop Moscow from skirting sanctions, as fears grow that goods are being funnelled through countries including the United Arab Emirates and Turkey.

Here’s what I’m keeping tabs on today and over the weekend:

-

Scholz meets Biden: The German chancellor makes his first state visit to the White House, with Ukraine on the agenda.

-

Moscow on alert: Vladimir Putin convenes his security council after a group claiming to work for Ukraine crossed into Russia and allegedly launched an attack.

-

Results: Rightmove, Pearson and Victoria’s Secret report.

-

Chinese politics: China’s rubber-stamp parliament convenes on Sunday. President Xi Jinping is expected to further centralise power by appointing loyalists to his economic team.

Thanks for all the feedback so far on FirstFT’s new look. Keep it coming at [email protected]. Have a great weekend.

Today’s top news

1. Fears for the London stock market’s future mount after SoftBank and CRH shunned the City yesterday. Both the owner of UK chip designer Arm and the world’s largest building materials group have chosen to list in New York instead. Here’s why the decision matters.

2. The US has renewed efforts to crack down on sanctions dodging amid growing concern that Russia is fuelling the war in Ukraine by funnelling imports through countries such as the United Arab Emirates and Turkey. Western allies also believe there are weak links in central Asia and the Caucasus.

3. US borrowing costs are at their highest point since 2007, with the two-year Treasury yield hitting 4.94 per cent and the 10- and 30-year yields crossing 4 per cent for the first time since November. The moves follow unrelenting data showing inflation is still running hot.

4. EXCLUSIVE: The UK’s Sizewell C nuclear plant could run into further delays as the government’s drive to raise about £20bn is now expected to conclude at the end of next year. It has been more than a decade since the project was launched. Find out why progress has been slow.

5. Koch Industries has appointed a co-CEO from outside the family, with Dave Robertson joining billionaire Charles Koch to lead America’s second-largest private company. Koch will continue as chair, a role he has held since 1967. Learn more about the man with whom Koch is sharing power.

How well did you keep up with the news this week? Take our quiz.

The Weekend Essay

Scientists warn we are not just facing a mass extinction event but that one is already under way. The anxieties surrounding the fragility of ecosystems, however, are as old as time. What can we learn about tackling climate shocks from studying thousands of years of humanity’s response to natural disasters?

We’re also reading and watching. . .

Chart of the day

The string of departures and prospective moves from London underline the UK’s difficulty in attracting and retaining companies — and US exchanges have been actively courting the dissatisfied. Here’s why companies are fleeing London’s stock market.

Take a break from the news

In Bali, plastic bags are getting a second life as homeware. Plastic flip-flops are transformed into art, and recycled bottle caps become a chair as a wave of designers, artists and environmental advocates turn the island’s copious rubbish into upcycled treasures.

Additional contributions by Gordon Smith and Emily Goldberg

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to [email protected]