Because the European Central Financial institution (ECB) lastly begins to boost charges, Greece is dashing to repay its excellent debt. The failure to consolidate eurozone debt harm the southern nation, whose debt spiked because of easy forex conversion. Greece stays probably the most indebted nation within the EU. The nation obtained its third bailout in 2018 and has been struggling to repay its debt, relying totally on bonds.

Greece is making its subsequent payout forward of schedule, because it is aware of that the quantity owed will solely rise. Greece is about to repay 2.7 billion euros, in accordance with the finance ministry. Nevertheless, it is a small piece of what they owe as money owed have greater than tripled because the begin of the 12 months.

Because the eurozone is going through an inevitable recession, Brussels is bound to search out its money owed. Greece has been put in a lose-lose scenario as its preliminary debt spiked after the drachma was transformed to the euro. Greece’s debt to GDP has soared since becoming a member of the euro. The ratio is anticipated to achieve 186.1% by the top of the 12 months, which is barely higher than 2020 (206.3%) and 2021 (193.3%).

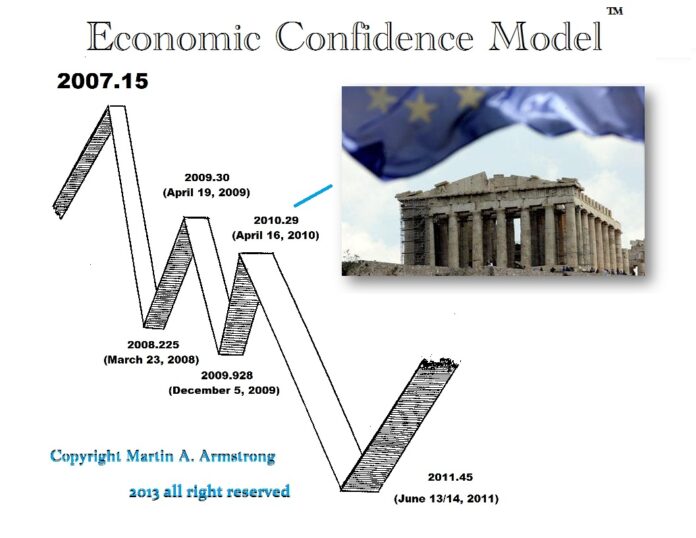

The whole EU Disaster started exactly on schedule on the political pi turning level from the key excessive in 2007. Exactly on the day of the ECM turning level, April 16, 2010 (2010.29), Greece notified the Worldwide Financial Fund (IMF) that it was on the verge of chapter. The eurozone and IMF offered Greece with a 260 billion euro mortgage – a small value to pay to stop the European economic system from crashing. Greece repaid the IMF 28 billion between 2010 and 2014. More cash was requested just a few years later. Quick ahead to 2022, and Greece wanted an extra 7 billion euros by way of bond gross sales. They’re merely making an attempt to remain afloat.