The higher your credit score, usually the lower your mortgage rate. Every time I went to apply for a new mortgage or refinance an existing mortgage, my mortgage lender would first ask for my credit score. If I said anything lower than a 720, they would politely tell me to look elsewhere.

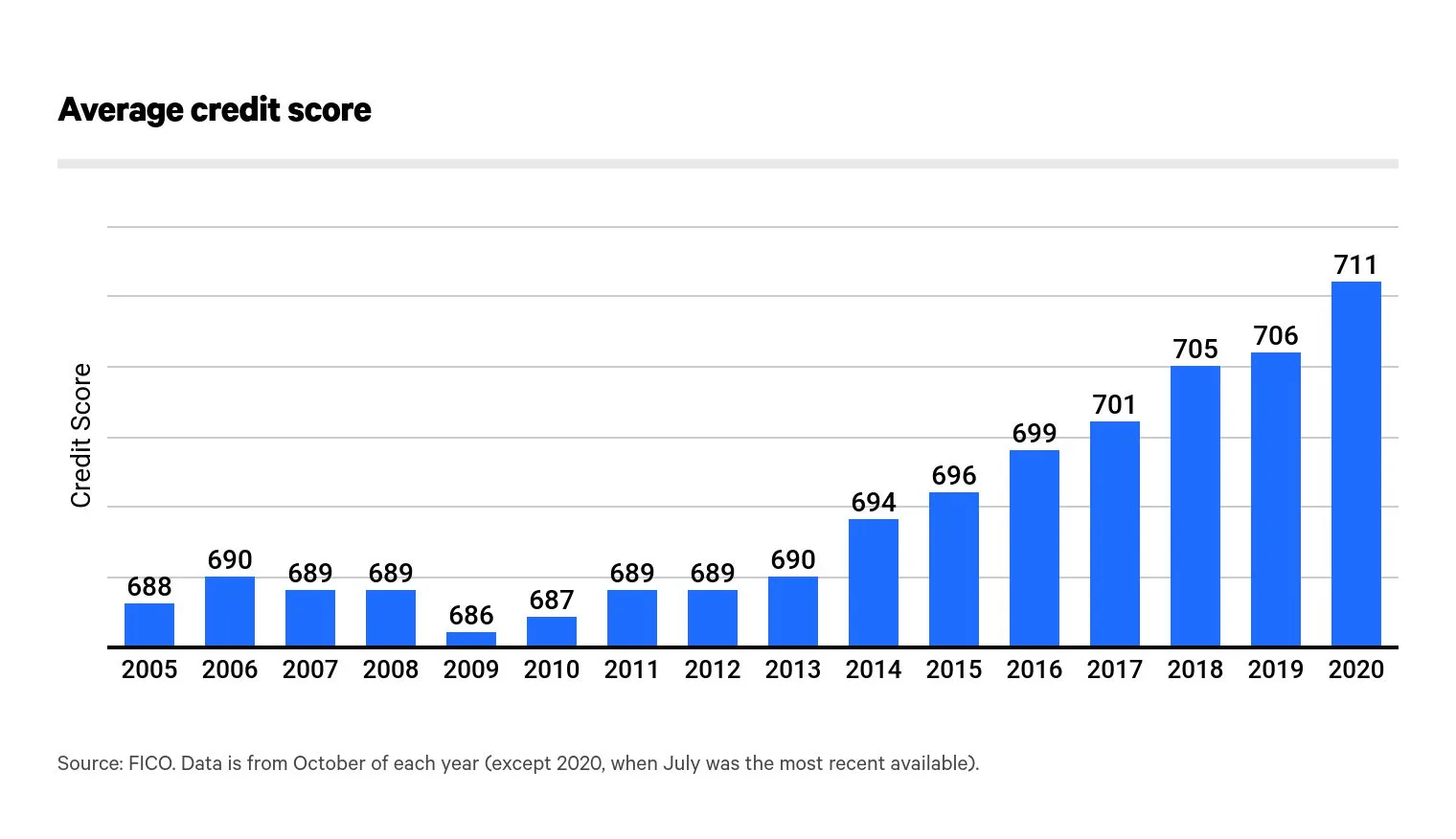

Before the 2008 global financial crisis, a credit score of 720 and above meant borrowers could get the lowest mortgage rate with the lowest fees. However, after about 2012, to get the lowest mortgage rate with the lowest fees often required at least an 800 credit score out of 850.

As a result, I decided to pursue strategies to get an 800+ credit score in order to save money. On September 6, 2013, I finally broke 800 and have stayed above 800 ever since.

An 800+ credit score enabled me to purchase a new property at a competitive rate in 2014. Then in 2018, I refinance the property to an even lower rate. More recently, I was able to buy a forever home in mid-2020 with a 7/1 ARM at only 2.125%. Being a responsible borrower has paid off.

But what if borrowers with higher credit scores had to pay higher fees? At the margin, it would disincentivize homebuyers from being responsible borrowers. As a result, lower-credit quality homebuyers would enter the market, thereby increasing the risk of another housing crisis.

This doesn’t sound great, but maybe there is a silver lining to this perverse incentive structure.

Higher Credit Score Now Means Higher Mortgage Rates

The Federal Housing Finance Agency (FHFA) has recalibrated the fee structure for loan-level price adjustment (LLPA) by lowering fees for some borrowers and hiking those for others.

Before May 1, 2023, for example, if you had a credit score of 740 or higher, on a $500,000 loan, you would pay a 0.25% fee, or $1,250. After May 1, you will pay as much as 0.375% – or $1,875 – on that same loan.

Paying up to $625 more in fees seems significant. It is a 50% increase from what you would have paid before the FHFA changed the rules.

In another example I saw, homebuyers with credit scores of 740 to 759 – considered “very good” – and putting 20% down will face a new LLPA of 1%, compared with 0.5% previously. For the purchase of a $500,000 home, that means the fee doubles to $5,000 from $2,500.

Would you be OK paying $2,500 more? I wouldn’t. Below is an example of various mortgage refinance bank fees.

If No Higher Fee, Then A Higher Mortgage Rate

If the homebuyer isn’t explicitly paying a higher mortgage fee, then the fee will get rolled up into a higher mortgage rate. The lender has to make money somewhere. Hence, don’t be fooled by a “no-cost refinance.“

The below graphical example shows someone with a 740 credit score paying a 0.25% higher mortgage rate than someone with only a 660 credit score. A 0.25% mortgage rate difference is significant.

In my experience of aggressively shopping around for mortgages, 0.25% is the biggest discount a competing lender would ever give me. And sometimes, I could only get a 0.25% lower rate by transferring assets and relationship pricing.

Lower Credit Score Now Means Lower Mortgage Fees Or Rates

If everybody is getting squeezed with higher fees and higher mortgage rates, then getting squeezed is easier to take. However, the Federal Housing Finance Agency has also decided to lower the fees for people with lower credit scores.

For example, starting in May 2023 a homebuyer with a credit score of between 640 to 659 and who has a down payment of only 5% will incur a loan-level price adjustment fee of 1.5%, down from 2.75%.

This means that someone purchasing a $500,000 home would now “only” pay an LLPA fee of $7,500, down from $13,750 previously. The original LLPA fee of 2.75% sounds egregious, so this is a significant benefit for these lower credit score potential homebuyers.

However, the lost 1.25% in LLPA fees is now being made up by homebuyers with higher credit scores. People with lower credit scores are either being rewarded or being given a break. Your view depends on your philosophy.

Mortgage Originations By Credit Score

The absolute percentage increase in fees higher credit score borrowers will now pay isn’t as great as the absolute percentage decrease in fees lower credit score borrowers will pay. However, the difference should be made up by volume.

People with higher credit scores make up the majority of borrowers.

Starting around 2010, the majority of mortgage originations came from homebuyers with 760+ credit scores. Then starting around 1Q2020, those with 760+ credit scores started to really dominate mortgage originations (light blue bar).

The main reason for these changes is tighter lending standards after the 2008 global financial crisis and the pandemic.

Given home prices have also boomed since 2010, wealth has mostly accrued to those with the highest credit scores. Meanwhile, those with credit scores under 660 have largely been shut out of the housing market since 2009 (yellow and dark blue).

The federal government looked at this data and decided to change the fee structure in the name of equitable access to home ownership. The wealth gap between homeowners and non-homeowners has grown too large.

You can read the Federal Housing Finance Agency’s clarification statement defending its new mortgage pricing.

Overall Implications Of Fee Changes Based On Credit Score

Once high credit score homebuyers they must pay this higher fee, they might negotiate harder with their lenders to get a greater discount. Shopping around for a mortgage is always a good idea. But this also means there will be further strain on the lending industry, which has already seen volume dry up due to higher mortgage rates.

If you work in the mortgage business, you probably feel like you’re getting kicked after you’ve already fallen down. Rationally, lenders will start pursuing homeowners with “fair” credit scores of 660 or less by pitching lower fees.

In addition, high credit score homebuyers may negotiate more aggressively with home sellers to get price concessions. More negotiating usually means longer closing times. Longer closing times often increase the chances of a deal falling through.

Higher fees for higher credit score borrowers mean lower lending and home sale volume at the margin. As a result, commissions earned in the real estate industry will also decline. Therefore, I should add unknown new government regulations as a risk to my positive real estate call for 2023.

Then again, if the lower mortgage fees and rates bring in more homebuyers, then there could be upward pressure on home prices. This, in turn, would enrich existing homeowners even further. And if more people are richer, there will be less crime and less strain on the government to provide.

Unintended Consequence: Hurting Asian Americans

Whenever the government decides to pick winners and losers, there are sometimes unintended consequences. Here’s one that I hadn’t thought of.

One “unintended” consequence of getting higher credit score borrowers to subsidize riskier borrowers is the disproportionate negative impact on Asian Americans. I put the word unintended in quotes because the government obviously sees all the data.

As an Asian American who grew up in Japan, Taiwan, Malaysia, and the Philippines for my first 13 years of life, I understand how Asians view debt: not good. Asian Americans are more allergic to debt. As a result, Asian Americans tend to save more aggressively and pay for more things with cash.

Therefore, it was no surprise when I learned Asian Americans have an average credit score of 745. Below is the average FICO score by race according to the U.S. Federal Reserve data. Every race gets at least a “Good” trophy.

Mortgage Application Rejection Rate By Race

Asking safer borrowers to subsidize riskier borrowers who’ve largely gotten left out of the housing boom is one thing. Enabling more Americans to own their primary residence is good for the nation, if borrowers buy within their means.

But what if you asked a group of people who were experiencing higher mortgage rejection rates than the baseline White borrower to also subsidize this riskier group? That would seem unfair.

According to a 2021 study by the Urban Institute, Asian Americans have a lower homeownership rate (60%) than White Americans (72%), despite having a higher median income.

One reason for this disparity, the study found, is that Asian Americans have higher mortgage denial rates than White Americans.

“We found that the denial rate for Asian mortgage applicants is 8.7%, compared with 6.7% for White mortgage applicants,” the authors of the study wrote. The authors studied the Home Mortgage Disclosure Act (HMDA) data.

“Asian applicants are denied more frequently than White applicants at all income levels,” the study reports. “In 2019, median income was $107,000 for Asian applicants and $82,000 for white applicants. For Asian applicants with annual incomes below $50,000, 16.3% were denied a mortgage, compared with 11.3% of White applicants in that income bracket.”

Why Are Asians Getting Rejected At A Higher Rate Than Baseline?

Nobody knows the exact reason why Asians are rejected at a higher rate for mortgages because the study also did research on rejection rates in big cities with large Asian populations.

The reason could be as simple as more first-generation Asian American applicants do not have the necessary documentation to get through the mortgage application gauntlet. I’ve been rejected before because I did not have at least two years of sufficient freelance income after I left my day job in 2012.

Always refinance your mortgage before leaving your W2 day job please. Once you no longer have a day job, you are dead to lenders.

For reference, according to Home Mortgage Disclosure Act data, 20% of Black and 15% of Hispanic loan applicants were denied mortgages, compared with about 11% of White and 10% of Asian applicants

Solution For Asian Americans And All People With High Credit Scores

If you don’t own a home yet, then your only course of action is to understand what’s happening and negotiate with your lender, real estate agent, and seller. Who knows. You might end up negotiating so effectively that you end up saving even more money. Too many people are too afraid to negotiate when it comes to buying a house.

Borrowers with high credit scores still get the lowest mortgage rates and pay the lowest fees. Such borrowers will simply have a slightly less good deal than before. Therefore, I wouldn’t try to game the system by purposefully tanking your credit score before applying for a mortgage.

If you are an Asian American looking to buy a home, you probably need to get at least a 760 credit score, if not a 800+ credit score to have the same chance of getting a similar mortgage as other races.

Keep your debt-to-income ratio as low as possible (30% or less). This is the most important ratio when trying to get a mortgage or refinance one. If you feel you are being treated unfairly, speak up! This way, you’ll increase your chances of getting a competitive mortgage rate.

Trying Harder Is The Way

Personally, I welcome the challenge to earn more, increase my credit score, pay down more debt, and work harder to take care of my family. I will teach these lessons to my children as well. Trying harder and being financially responsible tends to pay off.

At the end of the day, having a higher credit score and being in better financial shape makes life easier. If other people who are struggling are getting a break, then great. The amount of homeowner’s equity homeowners have accumulated since 1990 has been enormous.

Real estate makes up about 50% of my passive income. And passive income is what enables my wife and I to live more freely. I want everybody to experience this type of freedom as soon as possible.

Since 1999, I’ve also been paying a significant amount of taxes each year to help subsidize the ~50% of working Americans who do not pay any federal income taxes. Hence, paying another several thousand dollars in higher mortgage fees, if I decide to buy another house, is not a big deal.

After thinking things through, it feels like an honor to help others also achieve the American dream. I was able to come to America in 1991 for high school and build my fortune. I hope many more people get to do the same as well.

Reader Questions And Suggestions

What are your thoughts on the Federal Housing Finance Agency charging higher fees for those with higher credit scores? What are the implications of this new policy to the housing market? Are you for or against potentially homebuyers with lower credit scores getting to pay lower fees?

Shop around online for a better mortgage rate with Credible. You can get multiple real quotes in one place so lenders can compete for your business.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.