Traders are getting ready for an extended interval of excessive rates of interest than anticipated after the US central financial institution chair delivered his most hawkish speech thus far, vowing to make sure elevated costs don’t grow to be entrenched.

Jay Powell on Friday put an finish to any hopes that the Federal Reserve would step again from its dramatic tightening of financial coverage anytime quickly, as he reaffirmed his “unconditional” dedication to tackling excessive inflation.

“The idea of a dovish pivot has been squashed,” stated Brian Kennedy, a portfolio supervisor with Loomis Sayles. “Powell is a creature of historical past and to me that is additional affirmation that the Fed doesn’t consider inflation is rolling over and going again to 2 per cent.”

The eight-minute speech sparked a dramatic inventory sell-off with the benchmark S&P 500 sliding greater than 3 per cent — its largest drawdown because the June rout, when $14tn in worth was erased from the US inventory market. Hopes that the Fed could chill out its stance because the economic system slows have been shattered. All however six of the businesses throughout the inventory benchmark dropped, with shares of economically delicate homebuilders falling practically 5 per cent and chipmakers declining greater than 6 per cent.

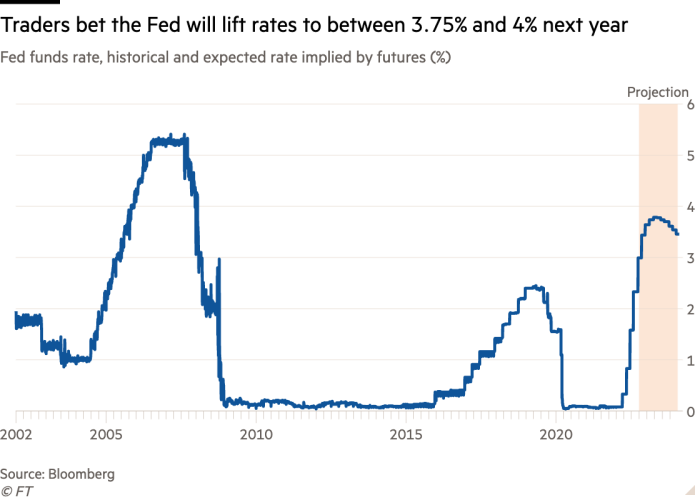

Merchants in futures markets shifted their bets as effectively. Whereas they nonetheless anticipate the Fed to carry charges to between 3.75 and 4 per cent within the first half of subsequent 12 months, they started to dial again their wagers that the central financial institution would start to begin chopping charges later that 12 months and into 2024 as they beforehand guess.

“It couldn’t be clearer that they’re going to maintain elevating charges and working down the stability sheet till they get clearly on high of inflation,” stated Bob Michele, the pinnacle of JPMorgan Asset Administration’s international mounted earnings, forex and commodities unit. “This fantasy that they may begin chopping charges a pair months after the final fee hike is nonsense.”

Michele added the truth that futures and Treasury markets didn’t react extra forcefully to Powell’s speech underscored the credibility drawback the Fed chair nonetheless confronted. Powell and his colleagues have run into criticism for arguing final 12 months that inflation would show transitory and in the end fall again in the direction of the Fed’s 2 per cent goal.

The extra muted transfer in Treasuries may additionally mirror the brutal sell-off they’ve already confronted this 12 months, cash managers stated, with the yield on the two-year be aware buying and selling just under a 14-year excessive struck in June.

The market ructions adopted Powell’s long-awaited speech on the first in-person Jackson Gap symposium of world central bankers because the begin of the pandemic, during which he careworn the Fed “should maintain at it till the job is completed” on inflation. He additionally acknowledged that tackling inflation will most likely have financial prices, together with a “sustained interval of below-trend development”.

“Whereas greater rates of interest, slower development, and softer labour market circumstances will carry down inflation, they will even carry some ache to households and companies,” he stated. “These are the unlucky prices of lowering inflation. However a failure to revive worth stability would imply far better ache.”

Citing the tumult of the Nineteen Seventies — during which the Fed made errors by easing coverage prematurely as a way to shore up development however earlier than inflation had moderated sufficiently — Powell vowed to keep away from that consequence. He additionally reiterated that charges might want to keep at a stage that restrains development “for a while” and emphasised the excessive bar by way of the financial knowledge to justify shifting to a less-aggressive stance.

Julian Richers, an economist with Morgan Stanley, stated Powell’s speech helped dispel the view the Fed could be swayed to loosen coverage because the economic system slows. Powell’s feedback following the Fed’s July assembly helped propel a reduction rally.

“This complete debate of a Fed pivot in July by no means actually made sense,” he stated. “In case you have been hanging your hat on the Fed being uber-dovish, that’s a course correction.”

Fed officers have but to determine whether or not a 3rd consecutive 0.75 share level fee rise is critical on the subsequent coverage assembly in September or if they’ll start shifting away from the “front-loading” part of the tightening cycle and reduce to a half-point fee rise. In simply 4 months, the federal funds fee has increased from near-zero to a goal vary of two.25 per cent to 2.50 per cent.

Economists consider additional fee rises will probably be mandatory in 2023 as a way to quell inflation, which they warn is at vital threat of persisting longer than anticipated.

Most have pencilled in a recession in some unspecified time in the future within the subsequent 12 months, with the unemployment fee rising effectively past its traditionally low stage of three.5 per cent.

“The nice unknown is how a lot the economic system really will sluggish within the near-term and at what level does the Fed acknowledge that,” Loomis Sayles’ Kennedy stated.