I haven’t had lots of success investing in actual property, not less than indirectly. That’s why I don’t speak about actual property investing greater than I do.

However about fours years in the past I began investing in actual property crowdfunding by way of Fundrise, and I’m completely satisfied to say I’ve been creating wealth at it.

I’d heard about Fundrise earlier than, and it appeared like a possibility to invest in real estate without losing my shirt. However as has develop into my approach through the years, I made a decision to leap in and provides it a strive. For me, that’s one of the best ways to be taught.

That was 4 years in the past, and I just lately acquired a congratulatory discover from Fundrise on my “anniversary”. That made now seem to be a great time to look again and see precisely how the funding has carried out.

It’s not only a matter of that efficiency both. I additionally wish to understand how that efficiency compares with the outcomes from actual property normally, from competing actual property investments, and in addition with non-real property investments.

I hope you don’t thoughts that we’ll be crunching a bunch of numbers right here. However that’s the one technique to know what’s actually taking place in the case of investing.

Who’s Fundrise?

Fundrise acquired began in 2012, and so they’ve since develop into one of many prime platforms in the true property crowdfunding house They might even be the prime platform. By 2019, they’ve originated $1.1 billion in industrial actual property transactions. That features each fairness and debt investments in properties with a complete worth of $4.9 billion.

As of February, 2021, the overall worth of actual property investments is at $5.1 billion, and the corporate has paid an unbelievable $100 million in dividends to traders.

Personal REITs

Again after I was a monetary planner I acquired concerned in personal actual property funding trusts (REITs). These are just like Fundrise, so I’m conversant in the idea.

As a monetary planner, you’re keen on promoting these investments. That’s as a result of they paid commissions of between 7% and 10% of the funding made. If a consumer made an funding of $100,000, you can earn $7,000 or extra in fee earnings. What monetary planners like simply as a lot is that when the investor sells their place, they normally weren’t conscious of the fee they paid.

Among the personal REITs did fairly properly – that’s, till the true property crash in 2008. It was worse than simply the declines within the worth of the trusts. In the course of the Nice Recession, tenants had been breaking their leases, money circulation dried up, and traders needed their a reimbursement.

At that time, the issue was that the principals who had been working these personal REITs didn’t have any money to pay again the traders. It was a liquidity disaster, which meant it was virtually unattainable to recuperate even a part of your funding.

That’s not an unattainable consequence with personal REITs. Buried within the high-quality print is language advising traders there could also be circumstances the place they’ll lose some or all their funding. However as you’ll be able to think about, few traders go into any sort of funding with the concept they’re going to lose cash on their funding, not to mention lose the entire quantity.

It even occurred to a pal of mine, or actually a pal’s mom. She put $100,000 or $200,000 into a personal REIT, then acquired the letter informing her it was all gone.

That’s not fairly how Fundrise works, which a giant a part of the rationale I like them.

The Fundrise Resolution

What you will have with personal REITs is a mixture of excessive threat and a scarcity of transparency on the charges related with the funding.

That’s precisely what Fundrise got down to treatment. Fundrise investments have decrease charges and full transparency in disclosing these charges.

What’s much more vital is that you just don’t want $100,000 or extra to take a position. You may make investments with as little as $500, which suggests virtually anybody can take part. Even in the event you do take a loss on an funding that small, it’s most likely not the sort that may wipe you out financially the best way personal REITs did to some traders within the final recession.

Fundrise does disclose the dangers of business actual property investing. That , contains the likelihood chances are you’ll not have the ability to liquidate your place.

Simply earlier than the COVID pandemic, I acquired a few notices from Fundrise making that time clear. The letters emphasised that if the market had been to take a giant dive, Fundrise is likely to be pressured to halt funding redemptions.

That’s simply an inherent threat with industrial actual property investments, just because actual property – and particularly industrial actual property – just isn’t a liquid funding. In contrast to a mutual fund, a personal REIT can’t promote inventory to boost money to pay traders. It’s additionally near unattainable to promote an workplace constructing or an house advanced in a nasty market the place there’s most likely no consumers.

It’s unavoidable, however I give Fundrise credit score for updating their traders about this chance frequently.

With Fundrise, there are not any upfront charges, and also you’ll know precisely what you’ll be entering into – together with the charges you pay alongside the best way.

Different Actual Property Crowdfunding Platforms

Fundrise isn’t the one actual property crowdfunding platform on the market. There are others that present comparable alternatives, additionally providing low investments and clear charge buildings.

YieldStreet works just like Fundrise in that they provide investments in industrial actual property. However in addition they embody various investments, like marine loans, paintings, and personal enterprise credit score. It’s most likely higher suited to extra refined traders with a giant urge for food for threat.

Groundfloor additionally invests in industrial actual property, however not in the identical approach as Fundrise. As a substitute of providing fairness investments, and a possibility for long-term development, they deal with investing in financing for industrial initiatives. You may make investments with as little as $10, and the investments are short-term – usually lower than one yr.

DiversyFund is one other actual property crowdfunding platform that invests in industrial actual property. However they focus totally on massive house complexes, which they really feel are higher long-term investments. You may spend money on their REIT with as little as $500.

I believe RealtyMogul might be the closest competitor to Fundrise. You may start investing with as little as $1,000, however the offers they spend money on are way more specialised. For instance, you’ll be able to spend money on particular person properties. However the one catch with RealtyMogul is that you just have to be an accredited investor, which suggests you have to meet sure fairly strict monetary standards to qualify.

The truth that there are a number of actual property crowdfunding platforms out there confirms a robust demand for any such funding. However simply as vital, the competitors forces every platform to supply a greater funding supply to their clients.

How Do You Get Began with Fundrise?

One of many large benefits with Fundrise is that they’ve their product on their website, and so they even supply cellular entry. That is not like these personal REITs I used to be speaking about earlier, the place data is difficult to search out, and infrequently buried within the high-quality print. Fundrise places all of it on the market, so that you’ll know precisely what’s occurring always.

You may join an account immediately on the Fundrise web site. It’s free to open an account, and you may select each the quantity you wish to make investments, and the particular plan that may work finest for you.

Fundrise affords 4 totally different plans, which I’ll go into intimately within the subsequent part.

Fundrise Plans & Portfolios

Fundrise offer four portfolios, Primary, Core, Superior and Premium. However in the event you’re new to investing in industrial actual property, chances are you’ll wish to think about the Starter Plan.

Starter Plan

One of many options of Fundrise I actually like is their Starter Portfolio. I do know there are different traders like me, who could have not less than a little bit little bit of concern about investing in industrial actual property. However that’s what this plan is all about.

You may spend money on the Starter Plan with simply $500, which is free to open. That’s a small funding, but it surely really supplies a formidable quantity of diversification. Not solely do they spend money on industrial properties, like workplace buildings and house complexes, however in addition they embody single-family actual property investments. You additionally get geographic diversification, for the reason that properties held within the portfolio are situated throughout the nation.

Primary

With an funding of $1,000, you’ll be able to spend money on their Primary Plan. That plan provides you entry to dividend reinvesting, auto make investments, and the flexibility to create and handle your funding objectives. The Primary Plan additionally provides you three months fee-free for every pal you invite to Fundrise who opens and funds an account.

Core

Subsequent is the Core Funding Technique, which requires a minimal funding of $5,000. That comes with all of the options of the Primary Plan, plus Fundrise’s personal eREIT fund, in addition to the flexibility to customise your funding technique.

That is the plan I’ve proper now, and it contains three totally different funding methods:

- Supplemental Earnings – that is the plan you’ll select in case your main curiosity is producing an everyday earnings.

- Lengthy-term Development – that is like investing within the inventory market, the place you’ll be wanting primarily at long-term capital features.

- Balanced Investing – this feature affords you a mixture of supplemental earnings and long-term development.

Superior

The Superior Plan requires a minimal funding of $10,000. With this plan, you’ll have all of the options and advantages of the opposite three plans, however you’ll get 9 months of charges waived for every pal you invite to hitch Fundrise. (They don’t say if the charge waiver applies solely on mates who join the $10,000 plan, or if it extends to any plan Fundrise affords.)

Premium

Lastly, there’s the Premium Plan, and requires a minimal funding of $100,000. I’m not going to dig into this one, as a result of it’s most likely past the scope of what most readers of this weblog are searching for, and even what I’d think about.

My Fundrise Portfolio

I began my Fundrise funding in February 2018 with $1,000 within the Primary diversified portfolio plan. A few month later, Fundrise was providing an preliminary public providing (IPO), which is one thing that at all times grabs my consideration.

However to make the most of the IPO, I needed to have not less than $5,000 invested, and that meant transferring as much as the Core plan. That was as straightforward as including a further $4,000 to my authentic funding.

The present steadiness of my account is about $11,113.83. Of that, $8,055.99 is the expansion of the unique $5,000 funding. The remaining steadiness within the account is my portion of the Fundrise IPO.

Focusing solely on the true property aspect, my $5,000 funding has elevated by $3,055.99 over simply 4 years.

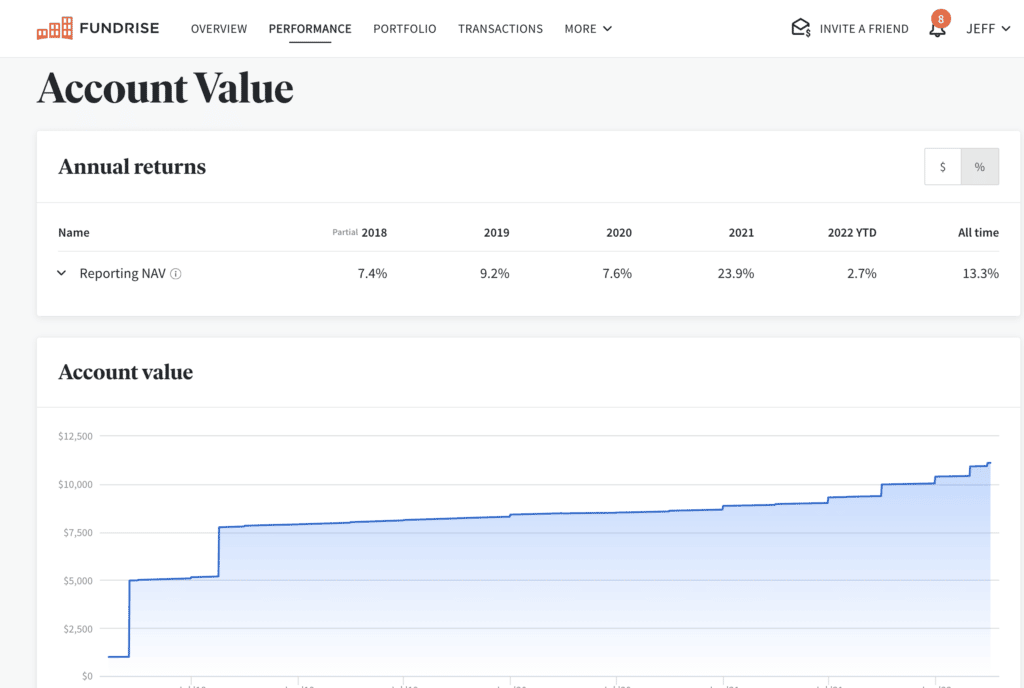

Right here’s how that breaks down by annual share return:

- 2018: 7.4%

- 2019: 9.2%

- 2020: 7.6%

- 2021: 23.9%

- 2022 YTD: 2.7

- Common annual return: 13.3%

I don’t have the complete greenback breakdown for annually, however right here’s what I do have, together with the break up between dividends and capital appreciation:

- 2018: Dividends, $274; capital appreciation, $74, for a complete return of $348, web of charges.

- 2019: Dividends, $383; capital appreciation, $131; advisory charge, $7.97, for a web whole return of $506.

- 2020: Dividends, $226; capital appreciation, $234, for a complete return of $452, web of charges.

- 2021: Dividends, $229; capital appreciation, $1,308.36, for a complete return of $1,528 web of charges

- YTD, by way of March, 2022: Complete return of $219, web of charges.

- Complete web return for all 4 years: $3,055.86

That is what I actually like! They break down precisely how a lot you earn, and in addition the place you earn it. In addition they let you understand when a property has been bought. All that data is on the market within the Fundrise dashboard.

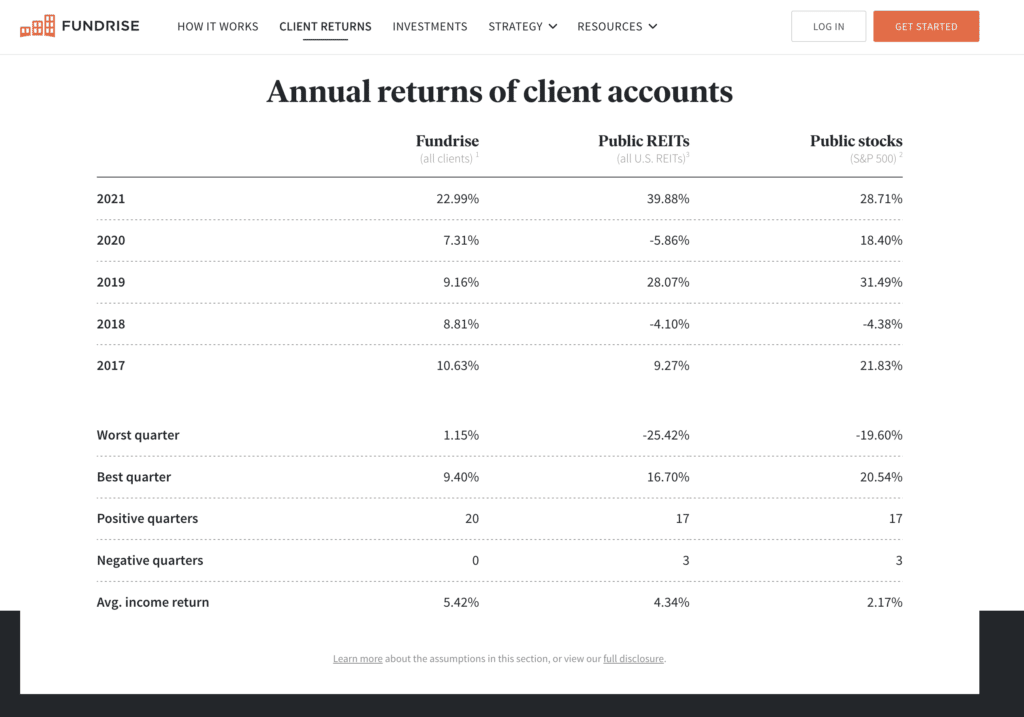

As a comparability of my returns right here’s what Fundrise shares on their web site:

My Particular Portfolio Allocations

I used to be most interested by long-term development, so I invested within the Development REIT. In addition they supply the East Coast, West Coast, and the Heartland (Midwest) REITs.

However in wanting on the distribution on my pie chart, it says I’ve 36% invested in fastened earnings, 15% in Core Plus, 33% in Worth Add (usually, renovation initiatives), and 15% in Opportunistic.

Not solely do I at all times know what I’m investing in, however Fundrise even provides me photos of what I’m invested in. For instance, one holding is a $5.8 million development venture, Mosby College Metropolis. It’s a 300-unit house advanced in Charlotte, North Carolina, and so they’ve introduced that it’s just lately been accomplished.

One other instance is the latest funding right into a single-family rental growth close to Dallas, Texas. It provides you the technique, which is Opportunistic, and the overall worth of $16.5 million. Others are initiatives in Atlanta, Los Angeles, and Austin, Texas. They even discloses some investments, situated close to the place I reside.

The purpose is, I do know the place my cash is being invested always.

How Do Fundrise Returns Examine with Different Investments?

So I’ve a median annual return with my Fundrise funding of 13.3% in simply over 4 years. However is {that a} good return?

All of it facilities on the essential query: “What if I had invested my cash in one thing else?”

That may embody different actual property investments, in addition to shares and crypto.

It actually depends upon what your funding objectives are, and what you evaluate these returns with.

Fundrise vs. Different Actual Property Investments

To recap, my four-year common return on my Fundrise funding was 13.3%, web of bills.

I can’t do a legitimate comparability amongst different actual property crowdfunding platforms since I’m solely invested with Fundrise.

However we will take a look at the Fundrise returns in opposition to these supplied by actual property trade traded funds (ETFs), that are broadly out there on market exchanges.

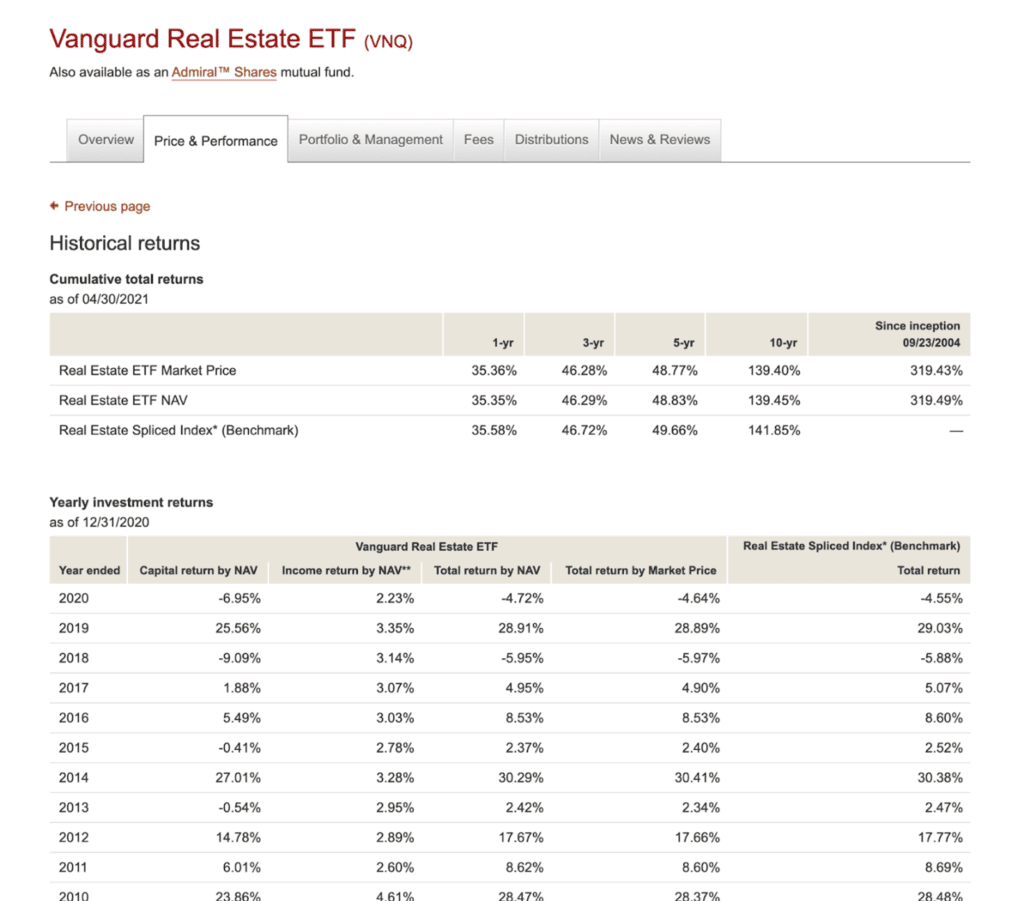

Fundrise vs. the VNQ

Most likely the most well-liked is the Vanguard Real Estate ETF (VNQ). This isn’t a full apples-to-apples comparability, as a result of I didn’t begin my Fundrise funding till roughly the tip of the primary quarter of 2018.

Even nonetheless, in 2018 my web return with Fundrise was 7.4%. This compares with a -5.9% for the VNQ. That’s a greater than 13% distinction between the 2 investments, and I’d reasonably make cash then lose it.

For 2019, my Fundrise return was 9.2%. VNQ had a return of 28.89%. Though I revamped 9%, it undoubtedly harm that VNQ made virtually 29%. For 2019 not less than, it was a 20-point swing in opposition to Fundrise.

What about 2020? Fundrise returned 7.6% for the yr, whereas VNQ was down 4.64%. That’s a swing of greater than 12% in my favor.

The performances in 2018 and 2020 had been no-brainers in favor of Fundrise. But when I had began investing in 2019, the funding with Vanguard would have produced a return thrice higher than what I acquired with Fundrise for that yr.

That’s a troublesome distinction to swallow, and if it had been taking place on a constant foundation I definitely wouldn’t be proud of Fundrise. Anytime an funding constantly underperforms the competitors, it’s nearly the very best proof you’re within the incorrect funding.

However Fundrise demonstrated a significant benefit over VNQ…

The Fundrise Consistency Issue

Though VNQ made Fundrise look dangerous in 2019, it simply outperformed Vanguard in two out of three years.

After I did a three-year calculation of the common annual returns from Vanguard, it got here to six.093%. That was properly beneath the 8.1% common with Fundrise.

However with that mentioned, a fast take a look at the year-to-date return on VNQ for 2021 exhibits a constructive return of 13.54% by way of the tip of April. In comparison with the 1.9% year-to-date return from Fundrise, it’s attainable VNQ pulled forward, or that the returns between the 2 are very shut.

Even nonetheless, the truth that Fundrise has had three consecutive constructive return years can also be vital. One of many main challenges for any investor is to keep away from dropping cash. That will be the case with a Fundrise funding over the previous three years, whereas VNQ turned losses in two out of these years.

Consistency issues with investing.

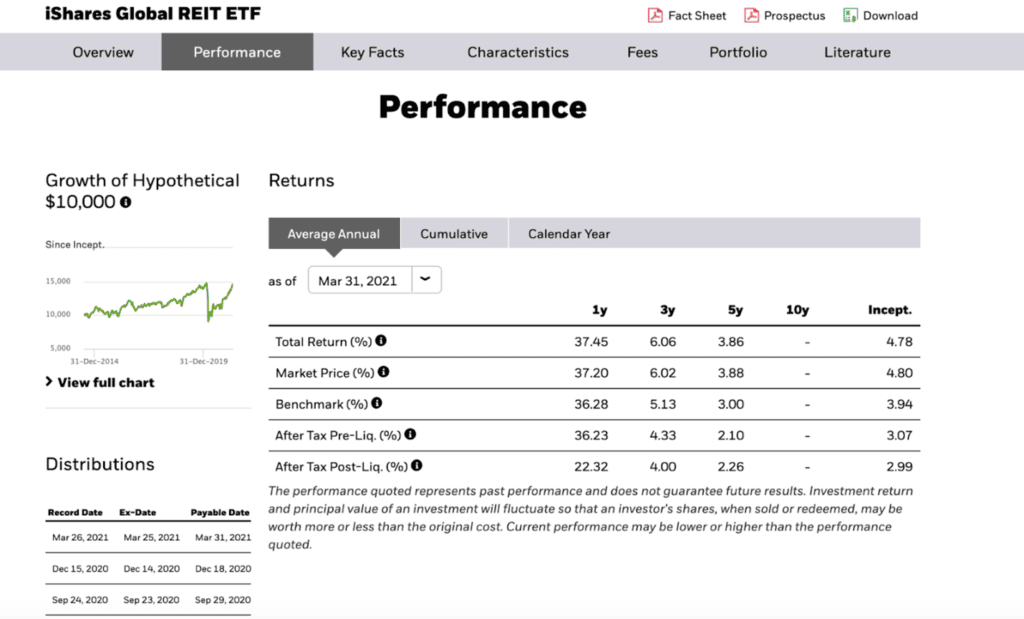

Fundrise vs. the REET

Let’s check out one other instance of the true property entrance, iShares Global REIT ETF (REET).

This once more just isn’t precisely an apples-to-apples comparability. The place VNQ is a US-based ETF, REET takes in actual property investments from around the globe.

Just like the VNQ, REET was down in 2018 by 4.89%. In 2019 it was up by 23.89%, then down 10.59% in 2020. I’m not going to interrupt down the numbers with this one, as a result of it’s fairly straightforward to see that REET underperformed each Vanguard and Fundrise on a median annual foundation.

In these two potential actual property investments, I’m not having any purchaser’s regret over my determination to take a position with Fundrise. It outperformed each alternate options over three years.

Fundrise vs. The Inventory Market

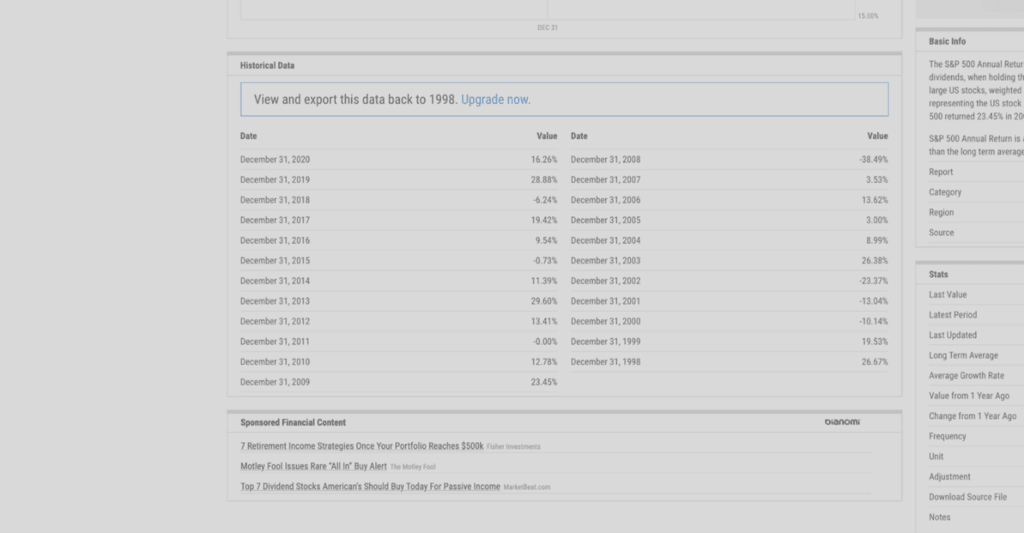

For 2018, the S&P 500 index was down 6.24%. In 2019, it was up 28.88%. And in 2020, is up 16.26%. By April 2021, we’re an unbelievable 57.9% achieve.

Nicely, however these are loopy returns – particularly in the course of a world pandemic. And I don’t know that we’ll ever see returns like that once more.

After I common out the returns on the S&P 500 index over the previous three years and involves 12.96% per yr. That’s virtually 5% per yr greater than my Fundrise funding paid.

(Supply: YCharts)

So clearly, if I had invested my $5,000 Fundrise funding within the S&P 500, I’d have come out forward. That’s a particular funding alternative value.

Fundrise vs. Crypto

Let’s transcend shares and different actual property investments and take a look at Fundrise in contrast with a real various funding: cryptocurrency.

This isn’t an arbitrary comparability both. I’ve been invested in crypto since 2018, together with my Fundrise funding.

We’re doing this only for enjoyable, as a result of definitely evaluating actual property crowdfunding with crypto is about as distant from an apples-to-apples comparability as you’ll be able to probably get. However let’s do it anyway!

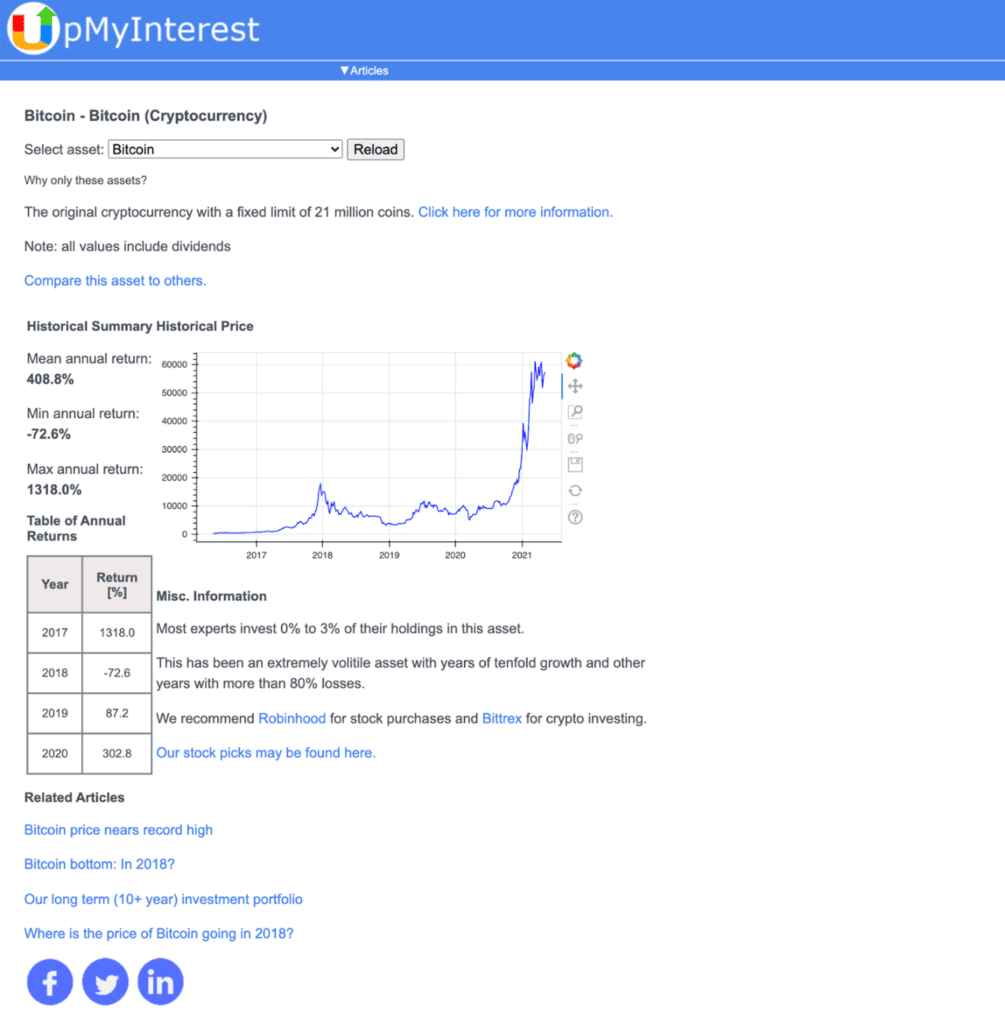

We’ll evaluate Fundrise with Bitcoin. The overall return for that crypto in 2018, was -72.6%. However that comes after 2017, when Bitcoin had a return of 1,318%.

However the state of affairs modifications within the subsequent two years. Bitcoin is up 87.2% in 2019, and 302.8% in 2020. What’s extra, Bitcoin continued to energy ahead within the first few months of 2021.

Trying on the common annual return on Bitcoin for 2018, 2019 and 2020, it’s an unbelievable 105%.

Thankfully, I used to be invested within the inventory market and crypto on the identical time I used to be in Fundrise, so I didn’t miss out. However now you will have a side-by-side comparability of how Fundrise performs in comparison with each industrial actual property and non-real property investments, like shares and crypto.

My Ideas on Fundrise

We’ve crunched lots of numbers on this evaluation, however I have to level out that investing isn’t all about returns alone. Extra vital is, what’s your purpose together with your cash? Or extra particularly, what are you hoping to make use of the cash for?

For instance, in the event you’re wanting to save cash to make a down cost on a home, or to retire early, an funding in Bitcoin that drops greater than 72% within the first yr isn’t going to get the job carried out.

One thing else I wish to level out is that the returns out there over the previous few years have been phenomenal, however they’re not typical. A correction goes to occur sooner or later, and when it does investments in shares and even crypto will take a giant hit.

I’m not attempting to unfold doom and gloom and advise placing all of your cash into protected investments. However all of us must be prepared for a correction. They’re going to be losses, which we noticed in each the Vanguard and iShares ETFs in 2018 and 2020.

Making Fundrise A part of a Balanced Portfolio

For me, I desire a diversification into actual property, however I’m not certified to spend money on particular person properties. I’m not interested by shopping for, renting, managing and promoting property, however I would like the diversification actual property supplies.

I did put cash into a personal REIT in my self-directed IRA, however that’s primarily for long-term investing for my retirement. It’s a totally passive funding, which is precisely what Fundrise does for me outdoors my IRA.

I exploit the “barbell investment method”. Which means I’ve some huge cash invested in protected investments, and a small quantity invested in excessive threat/excessive return investments. However I don’t have a lot within the center, which is mainly what Fundrise is. So for me, returns apart, Fundrise has a particular place in my portfolio. It provides me publicity to the industrial actual property market, plus common updates on what’s occurring in my portfolio.

A giant a part of constructing wealth is being concerned in numerous investments in order that I can know what’s occurring with totally different asset lessons. That doesn’t occur except I’m really invested in these asset lessons.

In order for you industrial actual property in your portfolio, I like to recommend Fundrise. It’s requires solely a small funding, supplies loads of funding choices, low and clear charges, and also you’ll at all times know what’s occurring together with your cash.