As Canon kicked off Japan’s company earnings season in late April with an improve to its annual revenue steering, chief government Fujio Mitarai welcomed the yen’s sharp decline as “a giant plus” for the printer maker.

Canon has been one of many largest beneficiaries because the Japanese forex fell via ¥130 in opposition to the greenback simply days earlier than its outcomes got here out. The yen’s tumble has made it cheaper to export the workplace gear it makes in Japan whereas boosting income earned abroad.

Different huge Japanese export names equivalent to Sony, Toyota and Nintendo have performed even higher, churning out report income regardless of Covid-19 disruptions. However what was lengthy a blessing for company Japan is out of the blue turning right into a menace because the yen’s spectacular fall to a multi-decade low coincides with a surge in commodity costs sparked by Russia’s invasion of Ukraine.

The Japan Iron and Metal Federation has warned that the yen’s fall presents “a threat for Japan’s producers for the primary time”. Noting that corporations import uncooked supplies to make and promote merchandise in Japan, Tadashi Yanai, outspoken chief government of Uniqlo proprietor Quick Retailing, has declared that “the weak yen has no advantage by any means”.

That’s not fairly the case. Financial institution of Japan governor Haruhiko Kuroda argues {that a} weak yen stays broadly positive for the Japanese financial system regardless of the difficulties it causes, notably for smaller companies depending on imports of gasoline and uncooked supplies.

However even for big exporters, the advantages of a weaker yen have waned in contrast with a decade in the past, when companies warmly welcomed then-prime minister Shinzo Abe’s efforts to drive the forex decrease via aggressive financial easing.

“Earlier than Abenomics, the yen was too robust so the transfer from ¥80 to ¥110 was welcomed. And a weak yen was handy to resolve deflation,” stated Kazuo Momma, government economist at Mizuho Analysis Institute.

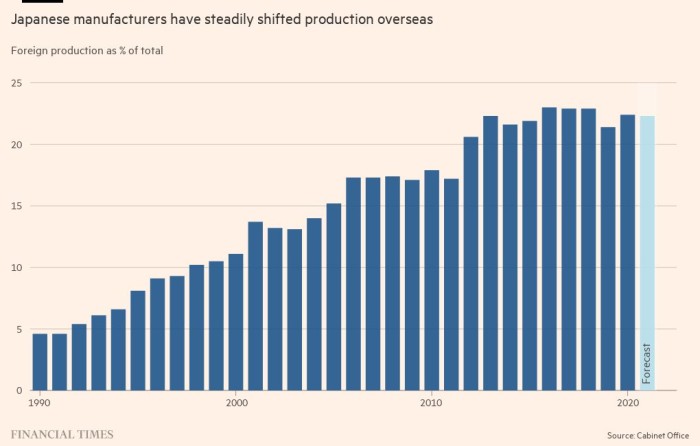

Japanese carmakers and different producers have shifted manufacturing abroad to cut back their publicity to forex volatility since being punished by a robust yen within the wake of the worldwide monetary disaster in 2008. The ratio of abroad manufacturing amongst Japanese producers rose to an estimated 22 per cent within the final fiscal 12 months from 17 per cent in fiscal 2007, in line with cupboard workplace information.

“If anyone tells me that ¥130 [against the dollar] is nice information for you, I’ll say it’s not excellent news and it’s not unhealthy information as a result of . . . we’ve crops everywhere in the world,” Ashwani Gupta, Nissan’s chief working officer, stated in an interview. “I feel we’ll say that something between ¥116 and ¥122 makes our operations the simplest globally.”

The widespread use of hedges to guard in opposition to swings in overseas trade charges additionally means Japanese corporations can not reduce export costs instantly in step with a weakening of the yen. Moritaka Yoshida, president of Toyota provider Aisin, stated responding was even trickier when the forex strikes as dramatically as when the yen dropped from ¥114 in opposition to the greenback in early March to ¥130 by the top of April.

One other essential distinction from the Abenomics period is the inflationary pressure now squeezing households. The yen’s fall has accelerated the worldwide rise in commodity costs, making every little thing from petrol to bread and greens costlier since Japan is a internet importer of oil and meals.

For Toyota, “an unprecedented” rise in uncooked materials and logistics prices will wipe ¥1.45tn ($11bn) from its working income for the fiscal 12 months via to March 2024, far outweighing ¥195bn in currency-related good points. Even contemplating the group’s conservative trade fee forecast of ¥115 to the greenback, in contrast with ¥128 on Wednesday, its prices from climbing metal and aluminium costs are unlikely to be offset by a weaker yen.

Toyota produces a 3rd of its vehicles in Japan, in contrast with lower than 20 per cent for Nissan and Honda. That makes it an even bigger beneficiary of the weaker yen, however analysts stated Japan’s largest carmaker was at an obstacle to international rivals when it got here to passing on the upper price of uncooked supplies to customers.

“Elevating costs for completed merchandise is just not widespread in Japan,” stated Takaki Nakanishi, an automotive analyst. “It’s comparatively simpler for people who produce abroad to boost product costs to deal with the rise in prices in the course of the manufacturing course of.”

The chip scarcity and different provide constraints have additionally prevented corporations from growing manufacturing from their crops. That has diminished the trickle-down impact of the weaker yen, which comes when corporations decrease within the provide chain profit as export giants spend money on factories at dwelling to broaden capability.

“The long run has turn into unsure because of the Ukraine disaster,” stated Wakaba Kobayashi, economist at Daiwa Institute of Analysis. “So whereas exporters are benefiting from the weak yen, they continue to be hesitant to make capital investments.”

Nonetheless, longtime Japan watchers equivalent to Nissan’s Gupta are satisfied the weaker yen will likely be good for the financial system as an entire if it might ultimately assist obtain the federal government’s long-stated aim of sustained domestically generated inflation.

“We’re seeing Japan graduating from deflation. That is nice information,” Gupta stated. “In fact it was pushed extra by the associated fee aspect, however I feel we’re getting right into a cycle when it is going to be pulled by the individuals.”

Further reporting by Antoni Slodkowski