Dear reader,

One of the pleasures of getting older is telling younger people how much easier they have it these days. Current strike action in the UK has provided me with an opportunity. Fellow journalists using the cliché “winter of discontent” present a target too tempting to resist.

My message for bright-eyed young pundits is simple: you lot would not recognise a winter of discontent if it came up and bit you. I am old enough to remember the dark months of 1978-79, which were given their apt Shakespearean title by the tabloid Sun newspaper. Industrial action right now does not even come close.

This is of relevance to the dwindling band of foreign direct investors in the UK. You have stuck it out thus far, through Brexit and the craziness of Liz Truss’s brief premiership. Train cancellations and industrial action by driving instructors represent a lower level of detriment to the investment case for the UK.

The difference is reflected in the fact that no one is currently quoting the ten-year gilt yield as evidence of national ruin. Just for the record, it is a relatively sane 3.5 per cent.

Most UK disputes involve public sector staff irked that real-terms pay cuts are set to deepen as a result of inflation, such as nurses. Rail workers, who tend to work for private companies employed on state contracts, have held regular stoppages. So have postal workers, whose privatised employer, London-listed International Distribution Services (aka Royal Mail) has public service obligations.

Earlier this week the government, the ultimate paymaster for most of these groups, finally held talks with union leaders, something it had previously avoided.

Back in 1978-79, strikes broke out all over the country and across the public and private sectors. Many of these were wildcat actions, which had not been prohibited firmly at the time. Rubbish went uncollected. The dead went unburied. Notably, Ford settled a dispute with workers by giving them a 17 per cent pay rise.

“The current situation is nothing like the late seventies and early eighties in terms of the scale and range of people taking strike action,” says Alex Bryson, a labour market expert at University College London.

My main memory of those times is of my own frivolous teenage disappointment at the lack of power cuts. We had those during miners’ strikes earlier in the decade. They were a lot of fun if you were a kid. Families told stories by candlelight instead of slumping in front of their TVs. For grown-ups, trying to keep the lights on was less enjoyable.

This chart gives a sense of how many strikes British workers would need to participate in to rival the labour insurrection of 43 years ago.

My aim is to introduce context, not to downplay problems NHS patients have getting treatment or disruption to individual businesses. White-collar employees are tooled up to work from home. But public transport strikes have delivered a real blow to some companies in the construction, hospitality and leisure sectors. Deutsche Bank calculates that up to 1.5mn working days were lost in the UK during December.

Recent industrial action may have shaved 0.25 per cent off UK GDP, estimates Simon French, chief economist at brokerage Panmure Gordon. However, he acknowledges this is “small beer” compared with the impact of Brexit and runaway inflation.

French points out that British output growth was higher in the strike-torn 1970s than the Bolly-swigging 1980s. The difference was that gains mostly flowed to labour in the first decade, but to capital in the second.

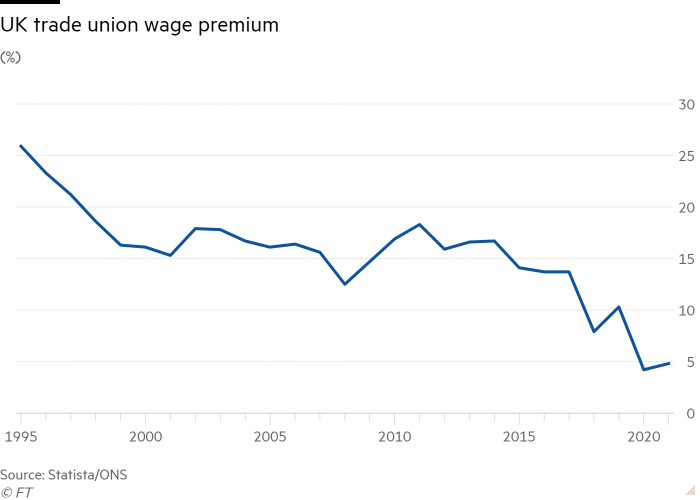

Should international investors worry that the flow is reversing? Hardly. Membership of powerful labour unions has slumped in the UK, as elsewhere. That is implicit in the reduced premium paid to union members compared to non-unionised staff. This reflects the banning of the closed shop and the decline of manufacturing industries where collective bargaining had a real impact.

International capital was wary of the UK in the seventies. These days, there seems little point in avoiding shares in UK businesses that are unionised for that reason alone. IDS agreed to a 3.7 per cent backdated pay rise before Christmas. Its main problem is its disappointing performance in parcel deliveries. UK train companies, typically units of larger groups such as Deutsche Bahn, are participants in a dysfunctional industry where economic incentives have been misaligned for years.

Jagjit Chadha, director of the National Institute for Economic and Social Research, says that following the Truss administration’s disastrous mini-Budget, the international community sees the UK as “an example of how not to do things”. Unresolved public sector union disputes are a problem prime minister Rishi Sunak therefore needs to address carefully. He must find a way to soften the blow from inflation to household incomes without busting his already-strained budget. Lower energy costs should give him some extra money to play with.

If industrial disputes persist and embroil more private sector employers then it will be time to worry. International investors would pay close attention. Which is more than I can expect from colleagues when I start sharing my wisdom concerning the three-day week, Red Robbo and the Grunwick dispute.

Reminiscing is the prerogative of older people. Ignoring those reminiscences is the prerogative of younger people.

Enjoy the rest of your week,

Jonathan Guthrie

Head of Lex

Further reading:

Sarah O’Connor on why pay negotiations are not a winner/loser situation.

Raghuram Rajan on the tricky relationship between central banks and credibility.

Department of shameless self-promotion: my own column on the risk of sanctions breakers using gold.