Good morning. A pleasant little micro-rally in shares yesterday, pretty much as good outcomes from Greenback Tree, Greenback Common, and Macy’s recommended that not each retailer was going to fall into the traps that Walmart and Goal did. However there could also be extra traps laid elsewhere, as I focus on under. Electronic mail us your ideas: [email protected] and [email protected].

And, if you’re within the US, benefit from the first lengthy weekend of summer time.

Inventories crack that whip

Method again in December I wrote in regards to the bullwhip impact. It really works like this: in response to a drop in provide or pop in demand, corporations in a provide chain over-order or hoard stock to guard themselves. The over-ordering amplifies because it strikes up the chain from retailer to wholesaler to producer to provider. The whip cracks when all of a sudden demand weakens and there may be an excessive amount of stock within the chain, resulting in a glut. I wrote:

The query is whether or not bullwhip results may back down subsequent 12 months [2022], resulting in oversupply at simply the identical time as rabid finish demand for items is cooling anyway as a result of (please, please) Covid is subsiding. This might result in provide gluts and even deflation. I’d hate to connect a chance to this, however it appears attainable however unlikely

Common Unhedged readers will now be thinking about Goal and Walmart. The shares of the 2 big-box retailers had been not too long ago clobbered after they ordered a variety of the improper stuff and ended up with billions in additional stock they’ve needed to mark down, at a price to margins. This does certainly sound slightly bull-whippy.

Albert Edwards of Société Générale thinks the Goal and Walmart scenario may very well be a part of a worldwide bullwhip phenomenon. In a current word to traders (during which he kindly talked about Unhedged) he argued that “unanticipated extra stock build-ups, particularly throughout a Fed tightening cycle, may also help to set off a recession”. He factors out that within the fourth and first quarters, US enterprise inventories grew by $212bn and $185bn, respectively, or roughly a per cent of GDP in every quarter.

If we’ve constructed up an excessive amount of stock, then it should be wound down, which is not going to solely creates the potential of value deflation (as within the Walmart/Goal case) however of much less orders for suppliers and producers. Who will this damage most? Most likely China:

If we settle for there may be a list problem on the retail degree within the US, producers are clearly going to see orders reduce . . . China is more likely to be particularly arduous hit — simply at a time when the authorities there are desperately attempting to revive progress. Whereas I feel it’s only a matter of time earlier than the Fed capitulates, possibly it’s going to really be China that’s pressured to (re-) open the liquidity floodgates first.

However is there an extra stock downside? General inventory-to-sales ratios don’t look very excessive. However, Edwards argues, when you have a look at sure sectors, the story will not be so fairly. Right here is his chart:

The chart doesn’t look to dangerous to me — it appears to indicate inventory-to-sales ratios solely a bit above pre-pandemic ranges. However the enhance was sufficient to make me assume. The place in addition to the stability sheets of huge retailers could extreme inventories be hiding? So I had a poke across the corporations within the S&P 500.

Whereas, once more, there may be not an apparent sample chopping throughout industries, at plenty of massive corporations inventories are transferring up remarkably rapidly. A few examples. Stanley Black & Decker is a giant firm that makes hand instruments, which had been in nice demand with bored do-it-yourselfers in the course of the pandemic. Here’s what its stock to gross sales ratio appears like over the previous 5 years:

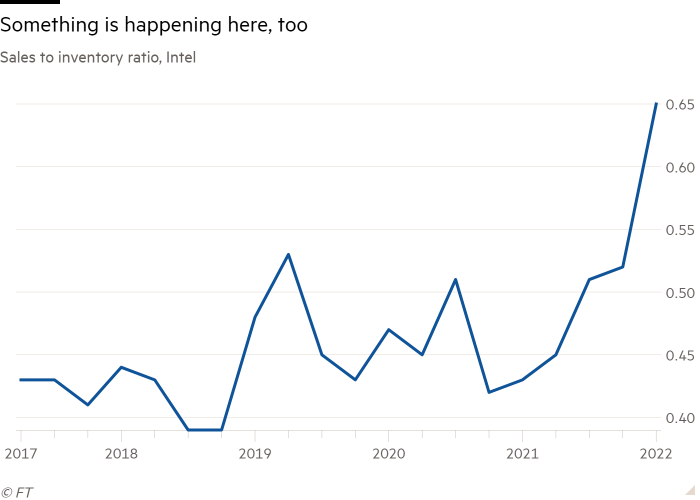

Intel is a giant firm that makes laptop chips, which there was not sufficient of in the course of the pandemic. Right here is it’s stock to gross sales ratio over 5 years:

These two corporations caught out to me as a result of they’re massive and vital, in disparate sectors, and all of a sudden have a variety of stock. However they aren’t alone. Throughout the S&P 500, comparable patterns had been additionally seen not simply at Goal and Walmart but additionally corporations corresponding to Garmin, Cisco, Monster Beverage, Ross Shops, and others.

I’m not leaping to any conclusions right here. It might be that the expansion in inventories at these corporations displays tactical selections in response to pandemic circumstances, and could be managed down easily. What do the businesses say? Right here is Stanley’s CFO Donald Allan on the corporate’s first-quarter name:

As a reminder, final 12 months, we made important investments in stock to assist meet the outsized demand within the instruments enterprise. Our 2022 money movement steering assumes that we are able to modestly scale back stock versus 2021 ranges, and we count on a lot of that enchancment to happen within the second half of the 12 months…

Our stock on the finish of Q1 was up roughly $850mn versus the year-end ‘21 stability. The rise in our first-quarter stock was primarily resulting from working capital seasonality to assist the height out of doors shopping for season, spring merchandising and the Father’s day promoting season.

That every one sounds wise, if demand is available in as anticipated. Right here’s Intel’s CEO Patrick P. Gelsinger, responding to a query about excessive stock ranges:

We’re constructing 10-nanometer [chip] stock. We now have new merchandise that we’re ramping into {the marketplace}. And we do see a few of these might be reversals as we go into the latter a part of the 12 months as that stock will begin flowing by the product space. So we’d say that is very typical administration of recent product ramps…

as we’ve indicated, we did see our prospects’ stock burn down in Q1. We count on a few of that to be in Q2 as effectively. However by the second half, we count on these changes and clearly the power of second half outlook, we do count on a lot of that stock burn to have completed within the first half and a powerful second half as we’re ramping our new merchandise.

Once more, there may be nothing unreasonable about this. It’s arduous to see from the skin who if anybody goes to get right into a Goal-style mess. However there may be clearly a variety of stock at large corporations proper now. I don’t know if Edwards is true and that’s more likely to contribute to a worldwide recession. However it’s clearly an vital factor to regulate.

One good learn

A worldwide financial system whistle-stop tour with Matt Klein and Cardiff Garcia.