This text is an on-site model of Martin Sandbu’s Free Lunch publication. Join here to get the publication despatched straight to your inbox each Thursday

The power worth shock is all everybody can take into consideration and is absorbing nearly your complete political bandwidth in most nations. That, in fact, is a component and parcel of Russian president Vladimir Putin’s plan: to trigger sufficient political bother domestically within the west to distract or discourage Ukraine’s mates from supporting the nation in opposition to his invasion. As I warned in my column this week, western and particularly European leaders should not enable that divide-and-rule technique to work.

I noted last week that when power manufacturing is at full capability the “marginal canine wags the combination tail” in power pricing. (This has occurred as Putin has artificially curtailed the capability accessible to Europe, which in any case is rightly working to cut back Russian power gross sales due to his conflict). Put merely, costs have shot up far above the price of extraction, manufacturing and era. The result’s an enormous redistribution of the financial worth of power from customers to producers.

A lot of the politics has centered on how that redistribution performs out inside nations: the right way to assist customers, tax producers and reform pricing processes. However we also needs to take note of the redistribution throughout nations. The switch of cash from power importers to exporters is astounding. Think about Saudi Arabia: within the earlier 5 years, its exports usually hovered round $20bn a month. Since Putin’s full-scale invasion of Ukraine, the value of its monthly exports has shot as much as $40bn.

The chart beneath shows the share modifications in export and import values, and the distinction between the 2, for various different nations. The modifications are measured between the final 4 accessible months (so after Putin attacked Ukraine) in contrast with the identical 4 months final 12 months. The chart orders the nations by the scale of the distinction between export and import progress. On the high sits Norway, whose exports earnings have almost doubled with imports barely modified. On the backside is India, whose import invoice has elevated 50 per cent however whose export earnings solely grew 15 per cent. For many nations, their place clearly displays their diploma of power import dependence.

Other than the large scale of those numbers, they present that financial pursuits should not fully aligned with the diplomatic faultlines of the conflict itself. These set a united liberal democratic world of superior economies in assist of Ukraine in opposition to Russia and its few shut allies. A lot of the rising economies are staying on the sidelines at a higher or lesser distance from the 2 clear sides. However inside every group, the power disaster hits nations otherwise.

On the liberal democratic facet, most however not everybody suffers from document power costs. It’s honest to explain Norway, particularly, as a conflict profiteer, raking it in from excessive costs for its exports of oil, fuel and electrical energy — to the purpose that some have known as for it to supply its friends at below-market prices. Different conventional commodity exporters similar to Canada and Australia are additionally doing greater than effective.

Notice that the US has not seen a giant deterioration in its commerce steadiness up to now 12 months of power worth rises. That stands to motive: the nation has on this millennium gone from internet power importer to largely self-sufficient. (As a substitute, the US commerce steadiness took a success within the first 12 months or so of the pandemic, when customers in America shifted their spending from providers to items at a novel scale. As I’ve argued earlier than, this, and never total extreme demand, was the primary driver of world inflation earlier than the previous 12 months’s power video games by Putin.)

There are additionally important variations among the many G20 economies outdoors the wealthy liberal democracies. Saudi Arabia and different petrostates are clearly beneficiaries. However Indonesia, too, has seen a giant bounce in export earnings. (So has China, however that most likely has extra to do with the worldwide restoration from the pandemic than with power commerce.) In the meantime, different huge rising economies along with India, similar to Brazil, Turkey and South Africa, are dealing with import invoice will increase that far exceed any export progress they could have had.

To get a deal with on the magnitude of those shifts, think about this: the total import bill for energy-poor EU and Japan put collectively is greater than $100bn a month increased since Putin began his conflict than it was one 12 months in the past. On an annual foundation, that’s greater than $1tn that largely displays extra money paid from power importers to exporters.

After which there may be Russia which, in fact, has racked up monumental surpluses. This isn’t only a operate of excessive power costs but in addition the collapse in its imports. However nonetheless, it has made monumental quantities on promoting oil and fuel to its enemies this 12 months. If numbers out of Russia might be trusted lately, its trade surplus has more than tripled since final 12 months. That revenue is very weak, although. Within the first seven months of the 12 months, gas export volumes have fallen 12 per cent because the similar interval in 2021; the continued squeezes on the fuel provide to Europe imply that drop is now lots larger.

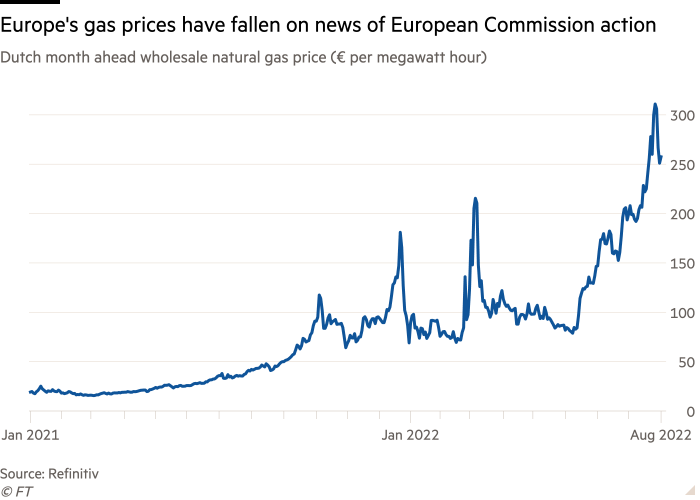

And Europe is clearly decided to make itself impartial of Russian fuel earlier than Putin closes the faucets for good. A couple of days in the past, information got here that Germany’s fuel storage was filling up faster than planned. France responded to Putin’s halting of gas deliveries to its foremost utility Engie this week by emphasising that its reservoirs have been 90 per cent full. That the frantic quest to fill reservoirs earlier than the winter is proving profitable could also be a part of the abrupt fall in fuel costs in the beginning of this week (see chart).

Certainly some observers say that after these reserves go from being crammed as much as being drawn down, the market may flip considerably. In any case, the view early within the conflict that it will be higher to wean ourselves off Russian gas voluntarily earlier than Putin cuts it off at a time of his selecting appears ever extra like the precise name.

Different readables

-

In regards to the hyperlink between marginal power costs and manufacturing prices — my colleagues have put collectively a list of options for the EU because the bloc discusses the right way to reform electrical energy pricing.

-

In a couple of days Liz Truss is anticipated to change into the following UK prime minister. Two new stories out at this time provide options for the way to consider reviving UK financial progress and funding. One is from the BCG’s Centre for Growth; the opposite from the Institute for Government. Each recommend that insurance policies should be much more advanced than merely pushing for tax cuts.

-

The UN’s report on the Chinese language authorities’s mistreatment of the Uyghur inhabitants has now been revealed. The FT has an explainer.

-

Reasons for the Federal Reserve to take a pause in its tightening.

-

Britain ignores placing dockworkers at its peril.

-

Edward Lucas sensibly proposes to make firms’ entry to the authorized system conditional on possession transparency.

Numbers information

Beneficial newsletters for you

The Lex Publication — Meet up with a letter from Lex’s centres all over the world every Wednesday, and a assessment of the week’s finest commentary each Friday. Join here

Unhedged — Robert Armstrong dissects crucial market developments and discusses how Wall Road’s finest minds reply to them. Join here