This text is an on-site model of our Unhedged publication. Enroll here to get the publication despatched straight to your inbox each weekday

Good morning. All of us have our petty dignities. Ours is refusal to write down about Elon and Twitter. However there was lots going available in the market’s much less absurd corners, together with a job openings report that inspired shares, already primed to rise, to rise quicker nonetheless. Is that this rally a repeat of August’s false daybreak? Tell us what you assume: [email protected] and [email protected].

Cooling within the jobs market

Keep in mind Fed governor Christopher Waller’s theory of a soft landing?

Right here’s a refresher. Waller argues that the pandemic has modified the labour market. Particularly, job vacancies — a measure of labour demand — have been a lot larger relative to unemployment. This creates the chance that tighter coverage may decrease vacancies — that’s, labour demand — with out elevating unemployment. Wage progress, and subsequently inflation, would fall too.

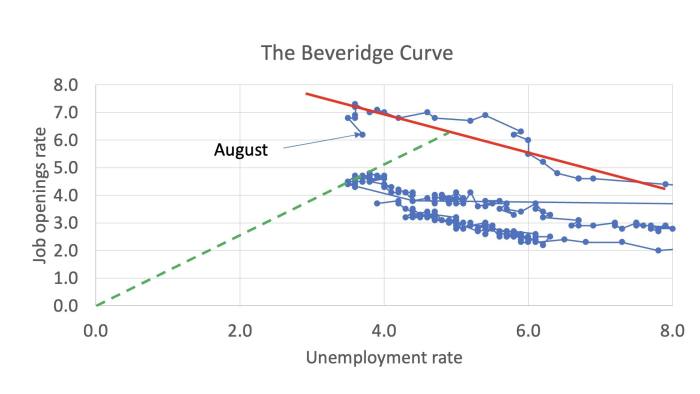

The graph beneath from Waller (which we’ve proven you earlier than) plots the emptiness price in opposition to unemployment, the place every dot represents one month. The shift he envisions would observe the inexperienced arrow beneath, snapping again to the pre-pandemic regime:

We’ve been sceptical of Waller’s concept. It’s exhausting for us to see why tighter financial coverage — which works by indiscriminately whacking demand — would narrowly decrease job openings with out additionally dragging up unemployment. Plus, as Skanda Amarnath of Make use of America has noted, the vacancies information simply may not be that dependable. It’s, in any case, cheaper and simpler than ever to publish a job itemizing on-line.

Yesterday introduced information that made Waller look prescient. Job vacancies within the newest Jolts survey fell exhausting, with 10 per cent fewer openings in August than July. Add this to anecdata on hiring freezes and lay-offs in some sectors, and a few are already recognizing a cooling labour market. Paul Krugman of the New York Occasions tweeted out this up to date model of Waller’s vacancies vs unemployment chart (referred to as the Beveridge curve), with the newest information flagged:

Krugman writes:

Two extra months like that (unlikely, however nonetheless) would restore the previous [relationship between vacancies to unemployment]. This implies that the disruptions within the labour market could also be therapeutic.

Sure, one month’s information, don’t rely your chickens and so on. However this was the very best financial information I’ve seen for a very long time.

This might affect Fed decision-making. Ian Shepherdson at Pantheon Macro referred to as it a “potential Fed game-changer”, arguing:

The frequency with which Mr Powell refers to this quantity signifies that it’s taken very significantly throughout the Fed . . . two extra Jolts experiences will likely be launched earlier than the December [Fed meeting], and in the event that they appear to be August’s the Fed won’t be mountaineering by 50bp or extra on the remaining assembly of the yr.

Possibly. We’d learn the openings numbers extra cautiously. Contemplate the large image. Inflation is the true goal right here. It’s edging down however nonetheless sizzling, and the Fed has set a excessive bar (“clear and convincing proof”) for letting up on price will increase. And even simply taking a look at labour market indicators, normalisation is a methods off. The quits price, a extra dependable measure of tightness than job openings, continues to be nicely above pre-pandemic ranges. On the tempo quits have fallen from their December 2021 peak, it will take 11 months to normalise:

From wage progress to hours worked, almost all labour market charts appear to be the one above: off their peaks, however removed from regular. Monetary markets care mainly about change on the margin, however the Fed has made clear that it’s going to wait till the development is clear. A lot nonetheless must go proper. (Ethan Wu)

China’s property disaster, international disengagement and the return to low inflation

Everybody ought to learn the big read on the Chinese language property disaster by our colleagues James Kynge, Solar Yu and Thomas Hale. Right here’s the core argument:

-

China’s introduction of the “three pink strains” debt limits in 2020 left builders with out the capital to finish pre-sold housing initiatives. These “hung” initiatives sparked a rout within the bubbly property market.

-

Broke or near-broke property builders, now not in a position to ponder new initiatives, have purchased a lot much less land from native governments.

-

This has left native authorities financing automobiles (LGFVs) in need of funds and prone to default. LGFVs are the primary supply of funds for infrastructure initiatives, from roads to energy vegetation, and the LGFV debt inventory is equal to half of China’s annual GDP. Yikes.

-

The underlying downside? Falling returns on debt-financed non-public and public initiatives. The killer quote, from a US investor: “The LGFVs took on debt at round 6 per cent and get returns on fairness of possibly 1 per cent . . . Most of them depend on subsidies from native governments. However now that native authorities income from land gross sales are down, a variety of the subsidies are simply stopping.”

-

The federal government has the means to cease this “sluggish movement disaster” from dashing up. However the debt-driven progress mannequin of latest a long time seems to be defunct.

-

This has international implications: “Between 2013 and 2018, in keeping with a research by the IMF, China contributed some 28 per cent of GDP progress worldwide — greater than twice the share of the US.” A contribution close to that degree appears unlikely sooner or later.

This remaining level matches right into a debate we’ve got aired within the area a number of occasions (most lately last week). Is the present financial second an aberrant incident throughout the low inflation regime of latest a long time, or an inflection level and a style of a extra inflationary world to come back? If China’s progress part is over, that helps the previous place. A slow-growing China ought to be deflationary.

A degree that appears essential to Unhedged is that change being pressured on China by the property disaster is strengthened by deliberate adjustments in Chinese language coverage — by the plan to create of what Kynge has referred to as “fortress China”.

On this context, it’s value studying the newest position paper from the European Chamber of Commerce in China. It opens as follows: “Though Europe and China already sit at reverse ends of a shared continent, it appears they’re drifting additional and additional aside.” A litany of complaints follows: rules masking international varieties have gotten extra stringent and fewer predictable; boundaries to new entrants to the China market are rising; efforts to reform China’s state-owned entities, which dominate key industries, have stalled.

The chamber’s report doesn’t title particular firms. However this summer season, for instance, the pinnacle of carmaker Stellantis (the product of the Fiat Chrysler/Peugeot merger) warned “there’s rising political interference in the way in which we do enterprise as a western firm in China”, after Stellantis dissolved a producing three way partnership with a Chinese language companion.

Beijing’s zero-Covid insurance policies make all this worse, however the chamber sees these insurance policies as extension of, fairly than an aberration from, enterprise coverage typically. Ideology is trumping economic system. The reforms and opening up of the Nineteen Nineties are a factor of the previous. Because of this, the chamber argues, European firms that have been as soon as intent on increasing within the nation are more and more targeted on assembly the challenges going through their current Chinese language operations. European funding in China is declining, and is now dominated by just some massive firms. Companies are actively exploring diversification of provide chains away from China.

The image painted by the chamber’s report issues for the trajectory of worldwide progress. It means that not solely will China battle to develop rapidly because it transitions away from the borrow-and-build mannequin, however that progress is now not a prime precedence of China’s policymakers — no less than not progress of the outward-facing type that the remainder of the world has gotten accustomed to.

One good learn

How in tarnation do you archive the internet? Seems it’s fairly exhausting.