Even with Prime Minister Liz Truss’s motion to stem rises in power payments, the financial ache is simply starting.

UK households nonetheless face pressures on their funds not seen for the reason that second world struggle. The identical is true for corporations. Caught by each rising prices and falling client spending, this pincer motion is troubling companies each massive and small.

To this point, with spending ranges nonetheless sturdy within the financial system, many corporations have been in a position to elevate costs to mitigate the problem. They may also obtain assist with a cap on non-domestic power payments this winter. Even with the underlying strengths and authorities help, the massive query is what occurs subsequent.

This can be a drama that’s prone to be performed out in three acts, culminating with company misery and a recession.

Act 1: Endless payments

Within the first quarter of 2022, common electrical energy payments for corporations had been about 30 per cent greater than a 12 months earlier. Rising payments haven’t stopped touchdown within the inboxes of firm managers ever since.

With a disaster level having been reached in early September, the federal government pledged to behave virtually instantly to forestall corporations being requested to pay as much as 5 occasions their earlier charges in fuel and electrical energy expenses.

It has promised to set a restrict on power payments for the following six months, with assist for some smaller corporations extending effectively into subsequent 12 months.

Even so, on the new managed worth, many corporations will nonetheless face a lot greater prices for power than a 12 months in the past.

Among the many hardest-hit corporations are energy-intensive industries, typically on the base of the availability chain, producing metals, plastics and different elements essential for manufacturing and constructing. These are actually feeling the pinch. Small enterprise confidence plunged in each the manufacturing and development sectors this 12 months.

Though oil costs have come off the boil in latest months, manufacturing corporations that use crude oil or different fuels together with fuel have seen the most important rise in prices over the 12 months to August. Gasoline costs have elevated about 50 per cent.

For the manufacturing trade, enter prices have risen 20.5 per cent in the latest 12 months, including to their challenges. With meals inputs additionally up about 20 per cent, costs of many grocery store objects have naturally risen sharply.

On the different finish of the availability chain, leisure industries that depend on heating massive areas, akin to retailers, swimming pools or nurseries, are having to show thermostats down and put costs up. Small businesses really feel they’re on the sharpest finish.

The squeeze just isn’t restricted to uncooked materials prices. In a lot of the service sector, corporations are affected extra by wage will increase than by greater prices.

Common pay grew at an annual price of 6.2 per cent within the non-public sector in July, the latest month out there. That was the very best price of improve this century, excluding a interval throughout the pandemic when the figures had been distorted.

Even so, pay is rising slower than costs, which had been 9.9 per cent greater in August than a 12 months earlier, placing strain on corporations to pay extra. This will likely be exhausting to withstand when there are at the moment as many vacancies as there are folks categorised as unemployed, twice the conventional tightness within the labour market.

In jobs in wholesale commerce, development and hospitality, marketed charges have risen sharply for the reason that begin of 2022, in line with Certainly.com, the recruitment web site. In contrast, marketed pay for nurses is barely rising, even after their companies had been in such demand on account of the pandemic.

Act 2: Rising borrowing prices

Firms have extra to be involved about than uncooked materials and wage prices. The price of debt is rising too.

Having saved official rates of interest near zero for greater than a decade, the Financial institution of England raised borrowing prices from 0.1 per cent final November and has signalled additional rises to assist convey inflation down. The Financial Coverage Committee set charges at 1.75 per cent in August and monetary markets anticipate them to rise above 3 per cent by the tip of the 12 months.

Giant UK corporations typically have mounted borrowing prices, limiting their publicity. The BoE thinks the proportion of enormous corporations dealing with materials dangers of reimbursement difficulties will rise from 30 per cent to 46 per cent on the finish of this 12 months. Rates of interest must rise to 4.5 per cent for this publicity to succeed in historic highs, capturing simply over 60 per cent of corporations. That, nevertheless, is now not above market expectation.

Smaller corporations usually are not almost as effectively protected. Whereas the brand new debt these corporations took on throughout the pandemic was usually at mounted charges, the BoE estimates that 70 per cent of their present inventory of loans is uncovered to rate of interest rises inside a 12 months. Many of those corporations will likely be uncovered to a nasty borrowing prices shock within the months forward.

On the identical time, corporations should take a look at gross sales. These have been falling on the excessive road and stress is obvious within the client confidence figures. This fell in August to a close to 50-year low as households apprehensive about their very own monetary state of affairs and the broader financial system.

Act 3: Spending underneath strain

Shopper spending will most likely fall additional. Meals, rents, mortgages, petrol and power costs, which account for greater than 40 per cent of family budgets, are all rising shortly. Many shoppers will lower down on discretionary spending this winter and give attention to the fundamentals. Poorer households will likely be pressured to make much more tough selections.

A survey of three,000 folks by SellCell, a worth comparability web site, confirmed a majority of households planning to chop down on leisure spending and consuming out. Solely 24 per cent of respondents mentioned they might not lower discretionary spending in any respect this winter.

Intentions to chop again don’t at all times lead to precise spending reductions, however the early proof from the excessive road suggests better spending restraint in non-food shops than in supermarkets, indicating that discretionary spending is prone to be hit.

With meals producers’ prices having risen about 20 per cent, the chances are high that meals worth inflation will rise farther from the August level of 13.4 per cent. That can put extreme strain on cafés, eating places and meals retailers to chop prices at a time when shoppers have gotten way more worth aware.

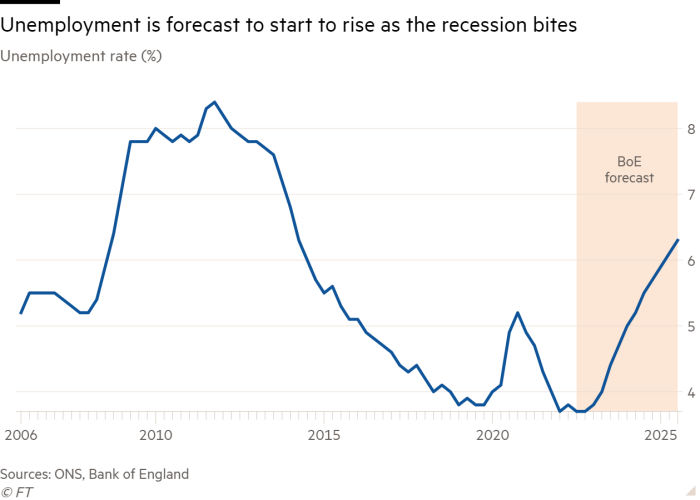

And the BoE nonetheless desires to impart a shock to make sure that inflation comes down. To the central financial institution, the next price of unemployment and decrease rises in wages are the required evils required to revive worth stability. The BoE thinks the recession will likely be shallow however final by a lot of subsequent 12 months, with unemployment rising to greater than 6 per cent.

The info suggests the method is already effectively underneath approach. Households are chopping again concurrently company earnings fall. Indicators of company misery such because the 42 per cent rise in corporate insolvencies since final 12 months are prone to rise even additional.

That is how recession begins.