The Financial institution of England went into full monetary disaster mode on Wednesday, speeding out an announcement that the central financial institution was restarting its cash printing presses at “no matter scale is important”, and later confirming it was planning as much as £65bn of latest quantitative easing.

Ministers have tried saying latest monetary turbulence was world, however nobody within the markets doubted the UK’s issues have been the results of £45bn of unfunded tax cuts in chancellor Kwasi Kwarteng’s “mini” Budget final Friday.

The plunge in sterling’s worth towards the US greenback and spike in authorities bond yields since Kwarteng’s fiscal assertion has thrown prime minister Liz Truss’s financial coverage into acute difficulties, and the BoE’s latest QE move raised additional questions.

All through her marketing campaign for the Conservative occasion management, Truss blamed the BoE’s post-financial crisis QE programme — which concerned printing cash to buy £875bn of presidency bonds to spice up the economic system — for inflicting inflation.

“A few of the inflation has been attributable to will increase within the cash provide,” Truss mentioned in July, however by September, her authorities had authorised the BoE to fireside up the cash printing presses once more.

The BoE mentioned the aim of its newest buy of long-dated authorities bonds was to revive monetary stability reasonably than increase inflation. The central financial institution sought to stop a man-made spike in yields on gilts with 20-year-plus maturities, which threatened the solvency of pension funds.

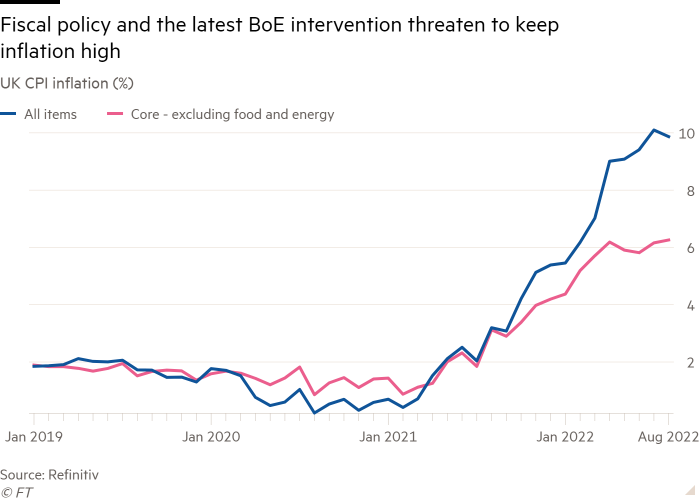

However analysts have expressed concern at how Kwarteng and the BoE seem like pulling in reverse instructions — by the chancellor’s unfunded tax cuts to spice up demand and the central financial institution’s strikes to lift rates of interest to curb excessive inflation.

Paul Hollingsworth, economist at BNP Paribas, mentioned: “It’s onerous to seem co-ordinated when fiscal coverage has its foot on the accelerator and financial coverage on the brake.”

The BoE’s place has been additional difficult by how its latest government bond buying move is going down concurrently it’s searching for to additionally tighten financial coverage, partly by gross sales of gilts collected underneath its post-2009 QE programme. The brand new authorities bond shopping for leaves the central financial institution open to accusations that it’s fuelling inflation.

Bethany Payne, bond portfolio supervisor at Janus Henderson Buyers, mentioned: “The Financial institution of England are generously providing to purchase long-dated gilts beginning immediately. That’s a whole flip on their announcement on Thursday final week the place they confirmed gross sales of gilts would go forward, beginning Monday October 3.”

With these contradictions undermining the credibility of UK financial coverage, the large query is what comes subsequent.

The BoE was adamant on Wednesday it could follow its present timetable for rate of interest selections, with the subsequent assembly of the central financial institution’s Financial Coverage Committee scheduled for November 3.

Gerard Lyons, chief financial strategist at Netwealth, who has been informally advising Truss, mentioned that if it probably may, the BoE “ought to keep away from inter-meeting selections” on charges.

This prevented a way of panic, and calibrating the size of charge rises in an emergency MPC assembly could be troublesome, he added.

The BoE additionally pressured it needed to exit its newest cash printing effort shortly: by October 14. It mentioned the asset purchases could be “strictly time restricted” though BoE officers additionally famous that conserving the intervention non permanent rested on a “signalling impact” working.

As soon as monetary markets may see the size of intervention the BoE was endeavor, central financial institution officers anticipated the turbulence would subside and consumers of long-dated authorities bonds would return even when yields remained a lot increased than in latest weeks.

Kallum Pickering, economist at Berenberg Financial institution, mentioned the BoE message was “don’t combat a central financial institution in its personal forex” since you may lose some huge cash.

In line with many economists, nonetheless, the BoE’s deeper downside was that by bailing out ministers, the central financial institution appeared keen to print cash to finance authorities, one thing it had beforehand pledged by no means to do as a result of it was inflationary.

They described the method as “fiscal dominance” as a result of the Treasury could be calling the photographs with the outcome that inflation may get uncontrolled.

Allan Monks, economist at JPMorgan, mentioned: “The optics are usually not beneficial for the financial institution and can inevitably immediate discussions about fiscal dominance and a financial financing of the [budget] deficit.”

“Bringing again bond purchases within the identify of market functioning is doubtlessly justified; nonetheless, this coverage motion additionally raises the spectre of financial financing which can add to market sensitivity and pressure a change of method,” mentioned Robert Gilhooly, a senior economist at Abrdn.

Over on the Treasury, Kwarteng, who’s scheduled to provide a keynote speech at the Conservative party conference on Monday, continued to return underneath stress to spell out how his unfunded tax cuts may coexist with sustainable public funds. The IMF on Tuesday launched a stinging attack on Kwarteng’s tax cuts, and urged the federal government to “re-evaluate” the plan as a result of the “untargeted” measures threatened to stoke hovering inflation.

David Web page, head of macro analysis at Axa Funding Managers, mentioned: “Clearly, the newest authorities insurance policies to disregard financial realities are politically very damaging, however they’re additionally proving economically damaging.”

He added that the chancellor had, till his speech subsequent week, “a possibility to about-turn [on his mini-Budget tax cuts and a] refusal to alter course is prone to exacerbate the pressures in UK monetary markets and improve the longer-term financial injury.”

Truss and Kwarteng have thus far refused to countenance a U-turn. Whereas reversing course on the chancellor’s tax cuts could be favoured by monetary markets, the IMF and some Conservative MPs, it appears the least seemingly path proper now.