This text is an on-site model of our Commerce Secrets and techniques publication. Join here to get the publication despatched straight to your inbox each Monday

Welcome to Commerce Secrets and techniques. It’s a kind of moments (that’s, more often than not) when there’s not loads of substantive commerce coverage as such occurring however quite a bit that impacts commerce. Final week there was an enormous flurry of central financial institution selections and fretting about alternate charges, which is the topic of the principle piece at present. In the meantime, the commerce ministers from the G20 met final week forward of the large leaders’ summit in November, however the entire course of nonetheless appears to be hobbled by geopolitical pose-striking. Charted waters seems at why in England it may not be so grim up north.

Get in contact. E mail me at [email protected]

Plaza Accord, Schmaza Accord

Sharp will increase in US rates of interest and a hovering greenback are inflicting world alarm. As former Commerce Secrets and techniques colleague Claire Jones writes, there’s a world backlash towards the Federal Reserve.

Wait a second. Is it . . . may or not it’s . . . are we heading for . . . would you like me to say the phrases . . . CURRENCY WAR? Effectively, you may see how the US authorities would possibly come to share widespread worries over the greenback’s energy, however there doesn’t appear a lot signal of it but.

The final massive foreign money battle was within the 2010s when US protests about an undervalued renminbi metastasised right into a normal moan that the US was itself intentionally weakening its alternate fee by quantitative easing. We’re presently seeing the inverse of that with tight US financial coverage and a powerful greenback, a replay of the early Nineteen Eighties that ended within the worldwide Plaza Accord in 1985 to weaken the US foreign money.

Not like the 2010s, inflation and therefore importing value rises by depreciation is an enormous concern, with many nations feeling themselves compelled to match the Fed’s will increase. Even the Swiss Nationwide Financial institution, which has been intervening like loopy towards the Swiss franc for years, build up epically huge reserves, is anxious about having a weak currency. It’s like a firefighter turning to arson.

As Mohamed El-Erian, legendary markets guru and now president of Queens’ Faculty, Cambridge, factors out, the route of the greenback’s journey makes complete sense: it displays greater US charges and development. “The issue is the magnitude of the change. Probably the most susceptible economies within the creating world are having to run very tight financial coverage at a time when they’re coping with different issues together with the slowing world economic system and power safety.” A string of debt defaults from lower-income nations which have borrowed in {dollars} is already beneath method.

In some circumstances different nations have made issues worse. Turkey, apparently operating financial coverage on a dare, is cutting rates of interest throughout an inflationary shock with predictable results on the Turkish lira. Japan intervened to assist the yen final week, its first shopping for operation since 1998. However the intervention is leaning towards its home financial coverage the place Japan is holding down the yield curve, persevering with to stimulate prefer it’s 2012. Within the UK, the announcement of an enormous fiscal loosening final week pushed up rate of interest expectations however hit sterling exhausting, the markets apparently concluding that the abysmal high quality of UK policymaking greater than offset greater yields.

However even issues amongst much less dysfunctional nations haven’t created a normal realignment motion. Why? For one, the standard foreign money pugilists, China and the US itself, aren’t presently that bothered. China, its economic system clobbered by the zero-Covid coverage and falling world development, might be helped by a weaker foreign money and has quietly let the renminbi slide, looking for solely to control its descent.

The US, in the meantime, wants some anti-inflationary strain and a powerful greenback gives it. Plaza occurred when internationally uncovered American producers and farmers complained loudly sufficient about competitiveness. We haven’t but acquired close to that stage.

Though President Joe Biden is obsessive about manufacturing, he has targeted on home industrial coverage primarily based on public spending aimed largely at serving the American market. Using home procurement provisions, such because the contentious tax breaks for electrical autos, defend US producers from worldwide competitors by subsidies reasonably than foreign money depreciation. Clearly this doesn’t assist US exporters in third markets, however for the second this doesn’t appear to be an enormous concern.

Biden has additionally saved most of Donald Trump’s tariffs towards China in place. To the extent that commerce protectionism and weakening the foreign money are substitutes for one another, thus far he’s gone for the previous.

How and when does the US grow to be involved and a few Plaza-type motion begin to be an actual chance? If US unemployment rises sharply and American business and labour unions focus once more on currencies, the underlying calculus will begin to shift. El-Erian reckons the more than likely rapid triggers might be a political problem or a “monetary accident” — some type of markets disaster.

Nevertheless it’s more likely to take some time. The Fed isn’t detached to struggling elsewhere, but it surely’s not its job to set financial coverage for overseas nations. Not till the US home pressures begin to transfer will Washington grow to be able to act. This episode of greenback neglect more than likely has some time to run but.

In addition to this text, I write a Commerce Secrets and techniques column for FT.com each Wednesday. Click on right here to learn the newest, and go to ft.com/trade-secrets to see all my columns and former newsletters too.

Charted waters

With the pound tanking towards the greenback, rates of interest escalating, excessive inflation and concern about recession, is there excellent news for the UK economic system? Effectively, there may be in case you are within the north of England.

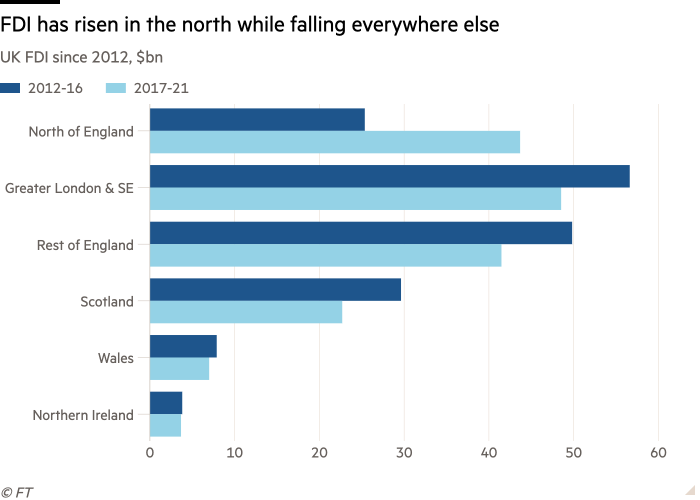

This area is the one a part of the UK that has attracted increased amounts of overseas direct funding, rising by virtually three-quarters, based on knowledge from fDi Markets, a part of the Monetary Occasions group, the Workplace for Nationwide Statistics and the Division for Worldwide Commerce, my colleague Jennifer Williams experiences.

The figures have been praised by the Northern Powerhouse Partnership, a foyer group created in the midst of the previous decade to carry the north’s financial significance, whose economists embody former Treasury minister Lord Jim O’Neill. Nevertheless it additionally fell to O’Neill to provide a actuality examine to the figures.

The FDI rise represented the one “notable success” to have emerged from the Northern Powerhouse push to spice up the area’s economic system, he famous. (Jonathan Moules)

Commerce hyperlinks

The stalling of the EU-Mercosur commerce deal has weakened Europe’s affect in Latin America.

Inside Vietnam’s makes an attempt to climb the worldwide worth chain.

IMF bailouts have hit a record high as fee rises push lower-income nations’ borrowing prices.

The Commerce Talks podcast seems on the Biden administration’s new approach to Indo-Pacific commerce.

Commerce Secrets and techniques is edited by Jonathan Moules